To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

When I was 25 I was dead broke. When I say dead broke I don’t mean “ I didn’t have very much money”. I mean I had negative money. My net worth was negative $50,000. As someone who had negative $50,000 to their name if I needed to get somewhere I had two options:

- Walk

- Take the bus

I lived in a small city with a reliably unreliable transit system. A bus that was scheduled to leave the bus stop at 10:30 might leave anywhere between 10:00–11:00.

That meant I spent a lot of time standing at bus stops. It was common for me to spend way too long waiting for a bus while holding way too many grocery bags. In the spring and summer, this was no problem. But, I live in Canada so for 6 months of the year, this was not so pleasant.

When the bus finally arrived, I would cram onto the bus with all my grocery bags hoping I could find a seat. If I could not find a seat I needed to secure my groceries with one hand and use my other hand to grab something to hold onto as the bus started moving.

I could not wait until I had enough money to buy a car. Now that I own my car free-and-clear and my net worth continues to increase, I find myself thinking; I can’t wait to get rid of my car.

Providing a little context

When I didn’t have a car I couldn’t wait to get one. Once I had one, I couldn’t wait to get rid of it. I know that sounds like a case of “the grass is always greener on the other side” but let me provide a bit of context for this.

First, I live in a two-car household. My wife and I both have cars. Going from 0 to 1 car makes life much easier and if you can afford it might even make sense financially given how much time it might save you.

Going from 1 to 2 cars provides some additional convenience. However, the extra convince brought by a second car pales in comparison to the costs associated with that second car (more on those costs in a minute).

Second, as I have moved further along my financial journey I have been increasingly thinking about how I spend my money. My goal is to spend as much money as I can on the things I value and as little as possible on the things I do not value.

I know one thing with absolute certainty; I do not value cars. To me, the only use I have for a car is to keep me from cramming onto that bus with my groceries in the middle of January. A 10-year-old car with cloth interiors accomplishes that goal with the same efficiency as a brand new sports car with all the bells and whistles.

Getting rid of your car can save your finances

For people who own cars, it is typically their second-largest expense in life behind housing costs.

If you are a homeowner, you will end up pouring a lot of money into your home. However, in 20–30 years you will have a paid-off house that has (hopefully) increased in value.

if you are a car owner, you will also end up pouring a lot of money into your car. Except by the time you pay it off the value of your car will be approaching $0. When the car finally dies, most people take out another loan to buy a new car. The cycle of pouring cash into your car continues in perpetuity.

If you decide to buck the trend and get rid of your car, you can save money in three different ways:

- You’ll need less money in an emergency fund.

- You’ll spend less money on paying off your debt.

- You no longer have the direct costs of car ownership.

Meet Sharon

I’ll illustrate the four ways you save money by ditching your car with the hypothetical example of a 37-year-old woman named Sharon. Here are the details of Sharon’s financial life.

Income

- Annual gross income: $100,000

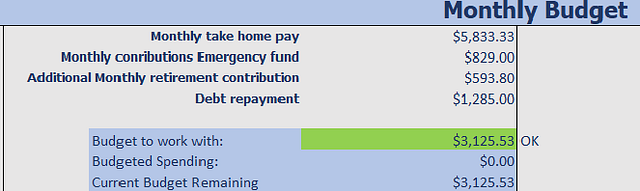

- Monthly take-home pay: $5,833

- Sharon’s employer offers a Defined Contribution retirement plan where she and her employer each contribute 5% of her annual gross salary.

Assets

- Current retirement assets: $175,000

- House: $350,000

- Car: $15,000

- Cash: $2,000

Total assets= $542,000

Debt

- Mortgage: $250,000 at 3%

- Car loan: $15,000 at 6%

- Credit cards: $2,000 at 19%

- Student loans: $25,000 at 5%

Total debt= $292,000

Net worth= $250,000

Sharon’s financial goals

Sharon has three major financial goals.

- Save 3 months’ worth of basic living expenses (housing, transportation & food)in an emergency fund within the next 12 months.

- Pay off her non-mortgage debt (using the avalanche method) in 3 years.

- Have enough saved to retire by age 65.

To accomplish her financial goals, Sharon will have to make the following monthly contributions:

- $829 to fund her emergency fund.

- $593 in additional retirement savings.

- ,285 to pay down her debt.

- This leaves her with $3,125 to cover her remaining expenses

When we also consider Sharon’s monthly housing and food costs are more than $2,400 this does not leave her with much wiggle room for her other living expenses.

Here’s how Sharon’s budget would look if she sold her car

Sharon’s monthly budget would look dramatically different if she sold her car (and paid off her car loan) and bought a monthly transit pass. She would save money in the following three ways:

- She would need to save $204 less per month to fund her emergency fund. This is because her basic living expenses and the amount she would need to save would be a smaller amount without the costs of a car.

- She would need to save $450 per month less to accomplish her goal of being debt-free in 3 years. By paying off the car loan she dramatically reduces her debt.

- She would save an additional $400 per month in other direct costs of owning a car such as insurance, gas, and maintenance.

By ditching her car Sharon can free up an additional $1,054 per month to allocate to the things she truly values in life.

You Might Also Enjoy:

Final thoughts

Every choice has an opportunity cost.

- Owning a car can save a lot of time and make life much easier. However, it also means you will have less money to spend on other things you value and can severely impact your financial health.

- Deciding to ditch your car will free up a ton of cash that you can allocate towards your financial goals and towards things you value like travel. However, that also means that you may be in the spot I was when I was 25; standing at the bus stop in January with both hands full of groceries.

There is no free lunch. The decision to own a car is simply a matter of which sacrifice you are willing to make. A financial sacrifice or a lifestyle sacrifice.

If your current financial circumstances are difficult you may want to consider making the lifestyle sacrifice and ditching the car. If you are in a strong financial position you may be able to afford the financial sacrifice of owning a car.

Choose wisely.

For more on how to reduce the cost of owning a car check out this story on turning your biggest expenses into cashflow.

About the Author

Ben Le Fort

In the eight years following graduation, he paid off all of the debt and built a seven-figure net worth. Ben holds a Bachelor’s degree in economics from Acadia University and a Master’s degree in Economics & Finance from The University of Guelph.

Ben lives in Waterloo, Ontario, with his wife, son, and cat named Trixie.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor