To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

After 60 years of regulatory prohibition, testimonial marketing now permitted by the SEC provides financial advisors with opportunities to accelerate the trust-building process and convert more prospects into clients.

✅ Download Free Templates and Checklists in Article Below

Hi, I’m Brian Thorp, founder and CEO of Wealthtender.

If you’re reading this, you know your online reputation matters and client testimonials are a powerful new tool to grow your advisory business thanks to the SEC Marketing Rule. What you may not know is how to navigate these uncharted waters.

As the founder of Wealthtender, the industry’s first SEC-compliant online reviews platform for financial advisors, I regularly speak with advisors interested in getting started with testimonial marketing and hear questions like these:

- How can I tactfully ask my clients to write a review?

- Can I invite non-clients and COIs to write a review?

- How can I promote testimonials to grow my business?

- And how can I do all of this compliantly?

In this ultimate guide to testimonial marketing for advisors, we offer answers to these questions and many more, with step-by-step instructions to get started and compliantly grow your business with testimonials.

As a financial advisor, compliance officer, advisory firm executive, or marketing professional, we’ll guide you through the development of your online reviews strategy with valuable tips and resources to ensure your success.

In just a few weeks, your client testimonials and online reviews can become an evergreen source of digital referrals and help you rank higher in search results, positioning your firm to lead the industry in attracting new clients.

Whether you choose Wealthtender as your partner to support your testimonial marketing strategy or prefer to follow another path, we hope you find this guide useful and wish you the greatest success.

Brian Thorp

Wealthtender Founder and CEO

(512) 856-5406

Table of contents

- Introduction: Testimonial Marketing for Financial Advisors

- Ask Yourself These Questions First

- Preparing Your Policies and Procedures

- Crafting Your Disclosures

- Choosing the Right Advisor Review Platforms

- Asking for Testimonials and Endorsements

- Promoting Testimonials and Endorsements to Attract New Clients

⭐ A Special Note for Wealthtender Subscribers

Throughout this article, look for information denoted by a gold star (⭐) with useful tips and resources to help you get started and succeed with Certified Advisor Reviews™.

Introduction: Testimonial Marketing for Financial Advisors

Imagine you’re a consumer in need of a financial advisor. Maybe you’re leaving your long-time employer for a new job and looking for financial guidance. Or perhaps you need help with college planning for a newborn. Or you’ve just lost a parent. You’re nervous, a little afraid, and concerned.

With a couple of clicks, you’re now online reading reviews written by clients of financial advisors who were once in your shoes. Suddenly, you’re feeling much more at ease. Your anxiety begins to subside as you realize other people with circumstances similar to your own gained relief when they found the right financial advisor. And now it’s your turn.

Energized and feeling confident based on the reviews you’ve read, you discover an advisor who is clearly trusted by their clients and may be a good fit for you. With one click, you book an introductory call on their calendar.

—

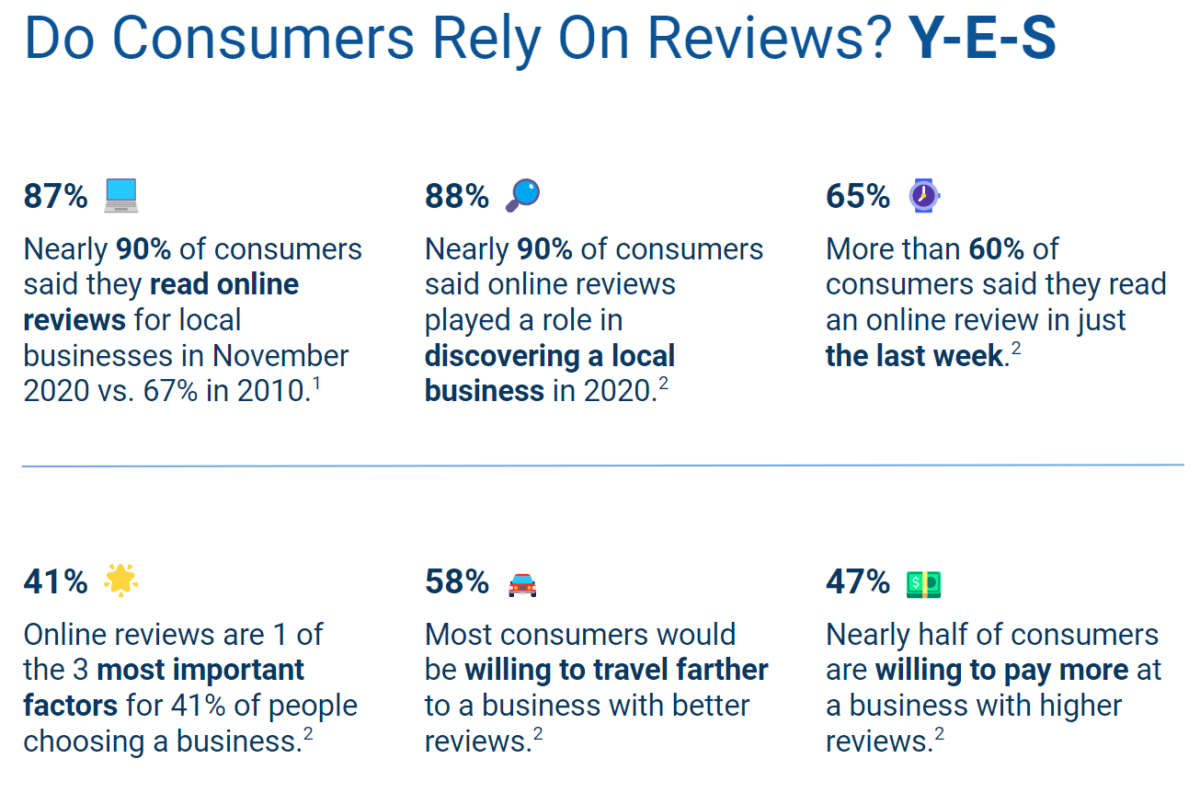

Scenarios like the example above occur thousands of times per day among consumers preparing to hire trust-based professionals like doctors and lawyers.

The same will hold true for financial advisors as their online reviews proliferate.

Consumers rely on a combination of facts and emotional cues when choosing a financial advisor:

Facts: Your education, credentials, and years of experience are facts that help consumers judge your credibility.

Emotion: Your online reviews build trust and satisfy consumers’ emotional needs, increasing their confidence in contacting and hiring you.

Do Financial Advisor Reviews Matter?

Over 80% of consumers say they read online reviews of doctors and lawyers when deciding who to hire. Now that the SEC permits advisors to request and promote client reviews online, we expect to see similar statistics among consumers hiring financial advisors in just two years.

If you decide not to make online reviews part of your marketing strategy, a nearby advisor or one in your niche with positive reviews is more likely to get the call. Today, you have a once-in-a-lifetime opportunity to get a head start on a powerful way to grow your business.

Ask Yourself These Questions First

Before getting started with testimonial marketing, it’s important to think about the big picture (and, of course, compliance).

If you’ve already established goals and metrics for your digital marketing strategy, consider the ways that client testimonials and online reviews fit into your current plan and the new opportunities they offer you to reach even higher. Or if you’re new to digital marketing or recently launched your practice, you’ll benefit by including online reviews in your marketing plan from the start.

Thinking about these questions upfront will help you establish an effective online reviews strategy tailored to your business goals and unique needs:

- What are the most important goals I want to achieve with testimonial marketing?

- Attracting new clients locally

- Increasing digital referrals nationwide

- Reinforcing confidence among my current clients

- Ranking higher in Google search results and SEO

- Improving the effectiveness of my website to attract more prospects

- Gaining recognition as a leading authority in my niche

- Strengthening the reputation of my firm

- Beyond my current clients, who else will I ask to write reviews and why?

- Leaders of local organizations who can speak to my character

- Professional acquaintances who know my work ethic

- COIs in my niche who understand the specialized services I offer

- How will I ensure my testimonial marketing strategy is effective and compliant?

- Working with my in-house marketing and compliance teams

- Partnering with a marketing consultant

- Hiring a third-party compliance expert

- Collecting and displaying reviews on SEC-compliant platforms

- Relying upon online resources to do it myself

- A combination of the methods above

Learn how United Financial Planning Group grows its business with a testimonial marketing strategy powered by Wealthtender.

How Client Testimonials Strengthen Your SEO 🔍

Do online reviews impact how prominently you rank in Google search results? While Google doesn’t disclose specifically how their algorithms work, they offer helpful information to understand better how online reviews for professionals like financial advisors can help or hurt your ranking in search results.

Positive online reviews increase your E-A-T, a term used by Google that stands for Expertise, Authoritativeness, and Trustworthiness. And YMYL (Your Money or Your Life) is how Google refers to websites that could significantly impact the quality of people’s lives, including their finances.

As a financial advisor, your website is already held to higher E-A-T and YMYL standards by Google than sites on topics of less importance to people’s lives. And now, financial advisors join other trust-based professionals like doctors and lawyers whose online reviews send powerful signals to Google’s algorithms which can influence how prominently you appear in search results.

It’s wise to include testimonials on your website. And it’s also valuable to collect and display reviews elsewhere on the internet as Google instructs its human quality raters to ‘look for outside, independent reputation information’ about you and your website.

By inviting clients to write reviews on reputable third-party websites, you’re providing Google with signals that reinforce your trustworthiness and could send more prospects to your website.

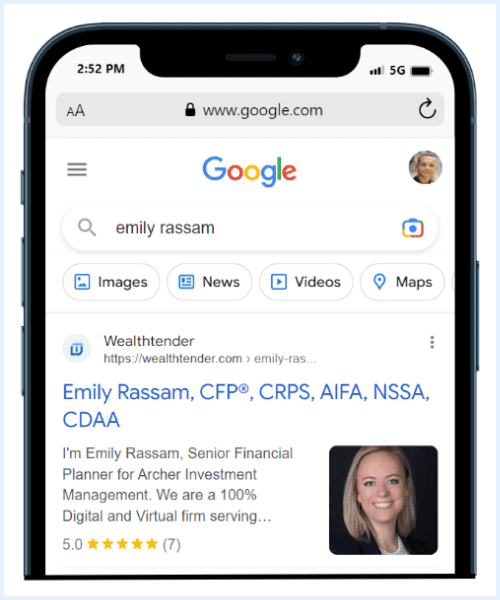

How Advisor Reviews on Wealthtender Are Displayed in Google Search Results:

Are You SEC or State Registered? Dually-Registered with FINRA?

While this guide is designed for SEC-registered investment advisors and investment adviser representatives, several state regulators now permit state-registered advisors to collect and promote testimonials by following the guidance on testimonials outlined in the SEC Marketing Rule.

And dually registered advisors subject to FINRA oversight when acting as registered representatives also have a clear path to get started with testimonial marketing by following the SEC Marketing Rule and guidance under FINRA Rule 2210.

Of course, no matter your registration status, you should speak with your compliance team and legal counsel prior to implementing any ideas featured in this guide or the accompanying resources. If you or your legal and compliance counterparts would like to dive deeper with us on a Zoom call, please schedule a time here.

Information for State Registered Advisors

As a State Registered Investment Advisor, it’s important to first confirm if your state regulator has granted approval for RIAs in your state to begin asking for testimonials. As of today, most states have not yet given the green light and it could take some time before they do.

To support state-registered advisors interested in getting started with testimonial marketing, I regularly reach out to state regulators to ask for guidance and advocate on your behalf. The table below reflects the feedback we have received from state regulators to date. (If your state isn’t listed, please feel free to send me an email: brian.thorp@wealthtender.com. I’ll be happy to reach out and follow up when we hear back from your regulator. Ideally, if you have contact information you can share, it can help us expedite a response.)

I like to remind state regulators that the SEC passed their new Marketing Rule for the benefit of consumers who rely upon online reviews to make more informed and educated hiring decisions. I also let them know how Certified Advisor Reviews from Wealthtender are designed for compliance with the SEC Marketing Rule to help put them at ease.

I’m a member of the National Society of Compliance Professionals and their SEC Marketing Rule working group. I also regularly speak with securities attorneys and industry stakeholders to advocate for State registered investment advisors in hopes we can quickly even the playing field so you’re not at a disadvantage to SEC RIAs who can get started with testimonial marketing today.

State Regulator Feedback Received by Wealthtender

Information for Hybrid or Dually Registered Advisors (FINRA)

While this guide is designed for SEC-registered investment advisors and investment adviser representatives preparing for compliance with the SEC Marketing Rule, it’s important for hybrid or dually registered advisors to concurrently satisfy their obligations for testimonials pursuant to FINRA’s rule 2210(d)(6).

Fortunately, you’ll find FINRA’s requirements fit easily within the SEC Marketing Rule framework. Hybrid or dually registered advisors should ensure online reviews also meet the following criteria:

- If the review discusses the investment advice you provide or investment performance, the review must prominently disclose the following:

- The fact that the testimonial may not be representative of the experience of other customers,

- The fact that the testimonial is no guarantee of future performance or success, and

- If more than $100 in value is paid for the testimonial, the fact that it is a paid testimonial

- If the review discusses a technical aspect of investing, the reviewer must have the knowledge and experience to form a valid opinion

FINRA requires that disclosures be provided in close proximity to the review or ‘through a clearly marked hyperlink accompanying the testimonial using language such as “important testimonial information,” provided of course that the testimonial is not false, misleading, exaggerated or promissory’.

Accordingly, FINRA required disclosures not already addressed within SEC required disclosures can simply be included alongside the SEC required disclosures.

Please note: This guide has not been approved or reviewed by the Securities and Exchange Commission (SEC) and is for informational purposes only.

JOIN WEALTHTENDER: THE #1 DIGITAL MARKETING GROWTH PLATFORM FOR ADVISORS

Preparing Your Policies and Procedures

As an SEC-registered investment adviser, the policies and procedures you develop for your firm’s testimonials and endorsements to comply with the SEC Marketing Rule will need to be incorporated into your existing written policies and procedures established to prevent violation of the Advisers Act.

Fortunately, the SEC Marketing Rule offers a principles-based approach with fairly clear and straightforward guidance so you can successfully grow your business with testimonials in a compliant manner.

In this section, we’ll guide you through important topics discussed by the SEC in the Marketing Rule, including opportunities and potential risks you’ll want to consider to help you prepare your policies and procedures for supervision of your firm’s activities associated with testimonials and endorsements.

And since it’s expected the most popular way to collect, display and promote testimonials and endorsements will be on the internet, this section includes practical tips and guidance to help you determine which financial advisor online review platforms may be most appropriate for your firm, including your own firm website.

⭐ At the end of this section, you’ll find a template you can download to help you prepare policies and procedures for your firm.

Asking for Testimonials and Endorsements

At the very heart of the SEC Marketing Rule is permission to ask for reviews from current clients (testimonials) and non-clients (endorsements), subject to conditions. But how and where you ask matters. We cover this topic in-depth later in this guide, so we’ll just touch on three quick points here:

1. The SEC wants to ensure you’re not cherry-picking reviews from your favorite clients, so it’s important to ask all of your current clients for a review when first getting started.

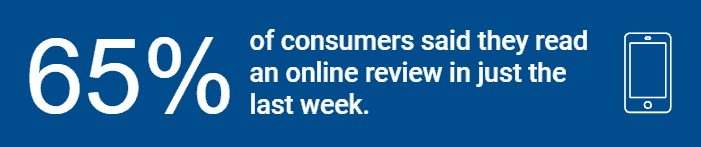

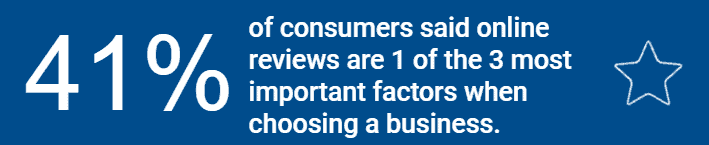

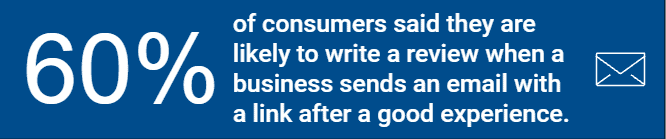

2. Asking for reviews may feel uncomfortable at first, but over 60% of consumers said they are likely to write a review when a business sends an email with a link after a good experience.

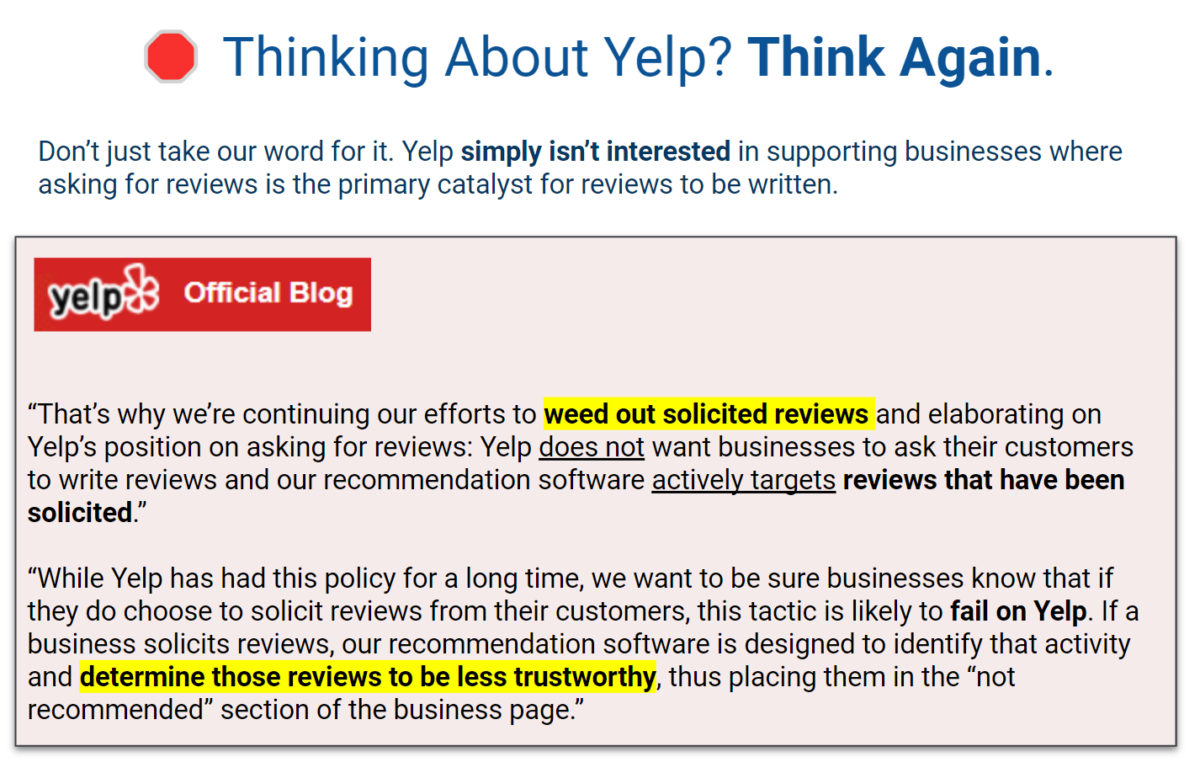

3. Think twice before asking for reviews on platforms like Google and Yelp. Since reviews on these platforms are not designed to include required SEC disclosures, promoting your Google or Yelp reviews is off-limits, and there’s not yet clear guidance from the SEC advising if simply asking for reviews on these platforms violates the Marketing Rule. Yelp’s policy also prohibits businesses from asking for reviews, and Google’s policy prohibits compensating for reviews.

Learn Our Concerns with Review Platforms like Google and Yelp

Why We Include Comparisons to Google and Yelp

If Google and Yelp are not compatible with the SEC Marketing Rule, you may rightly be wondering why we’re discussing these platforms at all.

Here’s What We Know with Certainty:

Google and Yelp are well-known review platforms popular with consumers. And financial advisors may already have unsolicited reviews written about them visible on these sites. If these are favorable reviews and are truly unsolicited, that’s terrific as advisors are gaining SEO benefits and visibility among consumers visiting these sites.

But because reviews on Google and Yelp lack the required SEC disclosures to be considered advertisements (e.g., testimonials and endorsements you can promote to grow your business), advisors can’t direct prospects to check out their reviews on these platforms.

⭐ This is one of the reasons why we provide tools to help advisors import their Google Reviews to their Wealthtender profile page where appropriate disclosures can be added, unlocking the power of these reviews to become SEC-compliant testimonials advisors can use to attract new clients.

Here’s What We Don’t (Yet) Know:

Unlike unsolicited reviews published on Google or Yelp, the SEC has not formally offered guidance to clarify if solicited reviews on Google and Yelp are deemed an advertisement and, therefore, subject to the prohibitions and disclosure requirements discussed throughout the SEC Marketing Rule. So the question we need the SEC to answer is: Does the act of a financial advisor simply asking for a review to be written on specific platforms like Google or Yelp entangle an advisor in its creation and trigger the prohibitions and disclosure requirements?

While industry opinions are mixed on the guidance the SEC will ultimately provide, we believe it’s highly likely the SEC will take issue with advisors proactively soliciting reviews on platforms known to be incompatible with the Marketing Rule. With its principles-based rule intended to ensure consumers gain important information to make more informed decisions, we don’t expect the SEC to look favorably upon a rampant proliferation of advisor reviews on platforms incapable of addressing the Marketing Rule’s prohibitions and disclosure expectations.

Further, we believe the SEC could point to FINRA Regulatory Notice 17-18 which addresses this topic covering testimonials of registered representatives. In the notice, FINRA states: “FINRA does not regard unsolicited third-party opinions or comments posted on a social network to be communications of the broker-dealer or the representative for purposes of Rule 2210, including the requirements related to testimonials in paragraph (d)(6).”

Wealthtender has submitted written requests for clarification on this matter to the SEC (likely along with many other industry participants), and we monitor the SEC’s Marketing Rule FAQ page daily. We’ll update this guide as additional SEC guidance becomes known.

Compensating For Testimonials and Endorsements (Cash & Non-Cash)

While the SEC allows advisors to offer compensation for testimonials and endorsements, any published review written by a reviewer who receives compensation must clearly disclose the compensation arrangement, even if it’s non-cash (e.g., gift cards, advisory fee reduction, etc.). And if you choose to pay a reviewer more than $1,000 in value within a 12-month period, you’ll need a written agreement in place between you and the reviewer. You should also consider the policies of online review platforms.

If you plan to offer compensation in any form, consider this guidance to comply with the Marketing Rule and policies of online review platforms:

Reviewers Compensated with Cash

- Disclose the amount paid, including any reimbursed expenses

- Establish a written agreement if > $1,000 within a 12-month period

Reviewers Compensated with Non-Cash

- If non-cash compensation is in the form of an advisory fee reduction, disclose the time period and discount percentage of the total advisory fee

- If the value of non-cash compensation is quantifiable in dollar terms, the dollar value of the compensation provided should be disclosed

- Establish a written agreement if > $1,000 in value is given within a 12-month period

Compensation Policies of Online Review Platforms

| 🔴 | No, compensation not allowed; No ability to add disclosures | |

| Yelp | 🔴 | No, compensation not allowed; No ability to add disclosures |

| ⭐ Wealthtender | 🟢 | Yes, compensation permitted; Yes, disclosures can be added |

| Your Website | 🟢 | Yes, compensation permitted; Yes, disclosures can be added |

🚦 You should be aware the SEC will consider the timing of compensation received by an individual relative to publication of their online review to judge in their eyes whether or not an individual has been compensated for their review. In other words, an incidental dinner, gift, or other consideration within an undefined window of time before or after the review, could be considered by the SEC to be compensation for the review.

Accordingly, even if your policy is to not compensate anyone for a review, the SEC might conclude otherwise if you offer cash or non-cash compensation to an individual around the time they write a review.

To comply with the SEC rule beyond the avoidance of doubt, consider erring on the side of caution and drafting your policy to disclose any cash or non-cash compensation received by a reviewer if the timing is relatively near the time of writing or publication of their review.

Anonymous Testimonials and Endorsements

Certain clients (and non-clients) may be interested in writing a review for you, but they prefer to remain anonymous (publicly) when their review is published. Fortunately, the SEC understands this and permits you to promote anonymous testimonials and endorsements when accompanied by proper disclosures. However, not all online review platforms allow reviewers to remain anonymous, and if the identification of the reviewer is unknown to you, you cannot promote the review as a testimonial or endorsement since you’ll be unable to add the required disclosures.

When evaluating online review platforms, take into consideration their policies and your knowledge of sensitive clients:

Anonymous Review Policies of Online Review Platforms

| 🔴 | Not allowed | |

| Yelp | 🟡 | Possible, if user sets up an anonymous Yelp account |

| ⭐ Wealthtender | 🟢 | Yes, with accompanying disclosures 1 |

| Your Website | 🟢 | Yes, with accompanying disclosures |

1 Wealthtender requires all reviewers to provide a valid email address. This information is only shared with their financial advisor to ensure the ability to add proper disclosures. Reviewers may choose to publicly display their full name, abbreviated name, or simply ‘anonymous’.

Reviews from Non-Clients (Endorsements)

Beyond reviews from your current clients (testimonials), the SEC also permits you to collect and promote reviews written by your past clients and non-clients (endorsements) when accompanied by proper disclosures clearly indicating the reviewer is not a client. While client reviews often help prospects better understand the client experience, reviews from others who know you well may help prospects learn more about your areas of expertise and character.

For example, consider the potential impact of reviews written by experts and professionals in your niche who can attest to your specialist knowledge; Or reviews written by leaders of non-profit organizations where you volunteer praising your dedication to the community.

Reviews from non-clients may be especially valuable among financial advisors who recently transitioned from another industry, younger advisors with few clients, but lots of credible references, and even newer investment adviser representatives who recently departed a broker-dealer and whose former clients were unable to transition due to a non-solicitation clause.

Monitoring for New Reviews

While there are countless general online review platforms making it nearly impossible to know if you receive a review on an obscure website, it’s likely your reviews will be posted to well-known online review sites like Google, Yelp, and industry-specific platforms like Wealthtender. Each of these platforms allows you to be notified when you receive a new review.

Monitoring for new reviews on these platforms should be fairly straightforward. Regardless, you’ll want to consider which online review sites you will proactively monitor and the email address you will associate with your accounts on these platforms. Do you want review notifications sent to your primary work email address? Or do you have a shared email account regularly checked by your staff that may be preferred to streamline oversight and recordkeeping?

Monitoring for Bad Actors

While unlikely to be a significant concern for most advisors, the SEC requires that your policies and procedures address how you will monitor for bad actors. (Note: Since the SEC is only concerned with paid testimonials or endorsements from individuals deemed bad actors, you can mitigate compliance concerns if you prohibit any form of cash or non-cash compensation for reviews.)

A bad actor is defined by the SEC as an ineligible person (or certain associated persons) who is subject either to a disqualifying Commission action or to any disqualifying event. The former includes any Commission opinion or order barring, suspending, or prohibiting a person from acting in any capacity under the Federal securities laws. The latter encompasses events in any of five categories, including court convictions and cease and desist orders that occurred within ten years prior to the person disseminating an endorsement or testimonial.

The SEC indicates, in addition to confirming a compensated reviewer is not a bad actor at the time their review is published, you should conduct an (at least) annual review to determine whether each compensated review is written by an individual meeting the bad actor definition. In such a case, the SEC requires that the review is updated to include clear and prominent disclosure indicating the reviewer is subject to a Commission order or disciplinary action, along with a link to the order on the Commission’s website.

Online Review Platforms: Ability to Comply with SEC Bad Actor Requirements

| 🔴 | Not possible 1 | |

| Yelp | 🔴 | Not possible 1 |

| Wealthtender | 🟢 | Yes, disclosures can be updated as required |

| Your Website | 🟢 | Yes, disclosures can be updated as required |

1 These platforms are not compatible with SEC disclosure expectations, but you can follow their procedures and attempt to request a review to be removed by filing a legal violation form.

Reviewing the Content of Testimonials and Endorsements

When you receive a new review, the policies and procedures you establish today can serve as a useful framework to satisfy your compliance obligations consistently and in a timely manner.

In this section, we cover three areas of utmost importance to ensure your compliance with SEC requirements.

1. Identifying and Addressing Prohibited Content

Upon receiving a new review, it’s important to review its content through a regulatory lens to determine if it includes prohibited content. Specifically, the SEC prohibits you from promoting reviews that (verbatim from the rule):

- Include any untrue statement of a material fact, or omit to state a material fact necessary in order to make the statement made, in the light of the circumstances under which it was made, not misleading.

- Include a material statement of fact that the adviser does not have a reasonable basis for believing it will be able to substantiate upon demand by the Commission.

- Include information that would reasonably be likely to cause an untrue or misleading implication or inference to be drawn concerning a material fact relating to the investment adviser.

- Discuss any potential benefits to clients or investors connected with or resulting from the investment adviser’s services or methods of operation without providing fair and balanced treatment of any material risks or material limitations associated with the potential benefits.

- Include a reference to specific investment advice provided by the investment adviser where such investment advice is not presented in a manner that is fair and balanced.

- Include or exclude performance results, or present performance time periods, in a manner that is not fair and balanced.

- Otherwise be materially misleading.

While this list of prohibitions may feel intimidating, you’re likely to find most reviews reflect a client’s perception of your character, qualities, personality, and experience working with you, which should be straightforward to address in accompanying disclosures as unique to the reviewer and not representative of a typical client.

In situations where a prohibition is triggered, you should discuss your options with your compliance team, which may include:

- Redacting or removing the prohibited language and publishing the review with accompanying disclosure to explain the redaction or revisions

- Not publishing the review on your website, or if on Wealthtender, requesting the review not be published due to an SEC prohibition

🚦 Keep in mind any reviews you receive on sites like Google and Yelp, whether or not they include prohibited content, cannot be promoted as a testimonial or endorsement due to their inability to comply with SEC disclosure requirements. Also, if you link to your Google or Yelp reviews from your website and any review includes prohibited content, the SEC could view this as fraudulent or deceptive.

2. Documenting Unsubstantiated Material Statements of Fact

While many reviews you receive will entirely reflect the opinions of reviewers, others may include a statement the reviewer believes to be fact. The SEC wants to ensure these claims can be substantiated by you upon demand if they are material.

In certain circumstances, you may want to include a statement of substantiation within the review’s accompanying disclosures for quick recollection of the circumstances if asked by the SEC at a future date. Such a statement also helps demonstrate to the SEC that you had a reasonable belief the statement was factual at the time it was written.

Consider two examples:

- A reviewer writes that you hold the Certified Financial Planner designation. Because this is an easily verifiable fact, no further action is necessary.

- A reviewer writes that you exclusively invest their portfolio in Vanguard funds. This statement may be factual at the time of writing but is subject to change. While this fact should be easy to verify in a future SEC exam, you’ll rest easier by confirming only Vanguard funds are in their portfolio at the time of writing and documenting your confirmation in the accompanying disclosure and/or your files.

3. Handling Spam and Inappropriate Content

The SEC supports the limited editing or removal of reviews which are spam, profane, defamatory, offensive, threatening, unlawful, or to correct a factual error, as long as the edits are not designed to favor or disfavor the advisor. Your policies and procedures should document how you will handle reviews of this nature in an objective manner.

🚦 Note: Reviews published on Google are scanned by their algorithms which occasionally mistake legitimate reviews for spam and remove them from the platform. When this occurs, and you inquire with Google about the removal, you’re likely to receive this message: “Sometimes our algorithms report and remove legitimate reviews. After a review is removed, we can’t reinstate it. These removal measures help make sure that reviews on Google properties are relevant, helpful, and trustworthy.”

Responding to Online Reviews

Although the SEC doesn’t explicitly provide guidance on whether or not you can reply to an online review, you should consider establishing your policy on this topic upfront.

A general rule of thumb and consensus opinion among securities attorneys familiar with the SEC Marketing Rule is you should never reply to reviews on platforms like Google and Yelp. Doing so substantially heightens your risk of entanglement and adoption as defined by the SEC, subjecting you to the rule’s general prohibitions and disclosure requirements which are incompatible with these platforms. Accordingly, you risk violating the SEC rule with no ability to regain compliance.

Whether you plan to thank reviewers who write favorable reviews or would like to respond to a neutral or negative review, consider establishing your policy to handle these communications individually with reviewers by email or phone.

And remember, it’s ok to have some neutral or negative reviews. In fact, studies conducted among other trust-based professions like doctors and lawyers show consumers tend to be skeptical of professionals without negative reviews.

What to Do About Negative Reviews

Let’s face it. One of the biggest fears of getting started with online reviews is waking up to find a new 1-star review with your name on it. Realistically, it’s much more likely your existing clients will write favorable reviews (or, at worst, neutral) and extremely unlikely a non-client you ask to write a review will be motivated to write anything negative.

So what’s the best way to overcome a negative review? First, take a deep breath. Next, take another. Seriously. (⭐ And if your first 3-star or lower review is received on your Wealthtender profile page, email yourfriends@wealthtender.com and we’ll send you a gift certificate for a 1-year premium subscription to the Calm meditation app. Also seriously. We’ll get through this together.)

Once your emotions subside, you’ll be better prepared to determine an appropriate and rational course of action.

Consider these suggestions if you receive a negative review:

- Put yourself in the shoes of the reviewer; Try to understand their motivation and what they might be feeling; You may come up with additional ideas to address their concerns.

- Is there a practical remedy to the reviewer’s concerns you can offer? If so, try reaching them by phone to humanize the discussion and see if you can reach a positive outcome.

- Whether or not you’re successful in resolving the concerns raised in a negative review, you can use the additional disclosures field accompanying the review to offer your own perspective on the matter. Take the high ground and avoid an emotional response.

- The best way to overcome a negative review is to earn lots of positive reviews!

A quick note: No matter the online review platform, consumers own the content they write, which means they are free to delete or edit reviews they have written or write a new review. We’re sharing this insight for educational purposes only and suspect the SEC could frown upon advisors encouraging a reviewer to revisit an existing review, so be sure to ask your compliance team for guidance if this is a path you’re considering. Also, even if a reviewer deletes a review, you should be prepared to discuss the circumstances with the SEC upon request.

While the circumstances of each review will differ, consider noting in your policies and procedures how you generally plan to handle negative reviews (e.g. responding offline by phone or email, etc.).

Review Aggregation

You are not permitted by the SEC to directly promote or refer prospects to your reviews on platforms like Google and Yelp, which don’t support required advertising disclosures.

Fortunately, with a reviewer’s permission, you can republish their review on SEC-compliant platforms like Wealthtender and your own website by adding appropriate disclosures. This is known as review aggregation.

By aggregating your reviews on platforms compatible with the SEC rule, you can turn reviews otherwise off-limits into powerful testimonials to proactively attract new clients.

In your online review policies and procedures, consider including a brief discussion of your approach to review aggregation. If you do choose to aggregate reviews from a platform like Google, your policy should be to aggregate every review from the platform where permission is received to mitigate SEC cherry-picking concerns.

SEC Marketing Rule and Compliance with the Advisers Act

Your policies and procedures for testimonials and endorsements should be incorporated into your existing Advisers Act policies and procedures. It’s important to review these combined policies and procedures in totality to ensure your handling of online reviews aligns with your procedures for advertisements.

For example, while the Marketing Rule does not explicitly require review and pre-approval of your online reviews, the SEC believes your existing obligations under the Advisers Act compliance rule for advertisements should: a) prevent violations from occurring, b) ensure your ability to detect violations that have occurred, and c) correct promptly any violations that have occurred.

If your existing policies and procedures already include pre-review and approval of advertisements, reviewing samples of advertisements, periodic reviews, and/or spot-checking, incorporating your online reviews into your current workflows should satisfy SEC expectations.

Because online reviews for financial advisors are new, the SEC also expects your Advisers Act policies and procedures to include training on the Marketing Rule, including its prohibitions and disclosure requirements.

SEC Marketing Rule Form ADV Update

A new section of Form ADV (subsection L under Item 5) has been added to describe your use of testimonials and/or endorsements, including online reviews (and other disclosures beyond the scope of this playbook). You’ll also need to disclose if you pay cash or non-cash compensation to reviewers. These questions are simply ‘yes’ or ‘no’.

Recordkeeping Requirements for the SEC Marketing Rule

The SEC expects you to maintain records of your advertisements, including online reviews and their accompanying disclosures, in an easily accessible place for five years (which can include cloud storage and email archives). If you already have an archiving solution, simply add any online review platforms to be archived as well.

Additionally, the SEC has updated the books and records rule to require that you make and keep any documentation that shows you have a reasonable basis to believe your online reviews are compliant with the Marketing Rule. By following a checklist for each incoming review and documenting your process, you’ll be prepared for a future SEC sweep or examination.

Crafting Your Disclosures

In this section, we’ll explain the specific disclosure requirements prescribed by the SEC for testimonials and endorsements to help you craft disclosures that are compliant with the SEC Marketing Rule. Beyond regulatory compliance, we’ll also discuss how thoughtfully prepared disclosures help consumers make more informed and educated decisions when evaluating financial advisors.

And since it’s expected the most popular way to collect, display and promote testimonials and endorsements will be online reviews, we focus our discussion on disclosures in the context of reviews published on the internet.

⭐ At the end of this section, you’ll find an Online Review Pre-Publication Checklist template you can download and use to ensure your testimonials and endorsements published online are compliant with SEC Marketing Rule requirements.

The Role of Clear and Prominent Disclosures for Testimonials and Endorsements

To avoid the disclosure fatigue we’ve all grown accustomed to in advertisements frequently overshadowed by paragraphs of fine print, the SEC deserves credit for its refreshing approach emphasizing the value of clear and prominent disclosures to accompany online reviews.

These clear and prominent disclosures are intended to provide consumers with important information to judge the merits of each review, including if:

- The reviewer is a client or non-client

- Cash or non-cash compensation was paid for the review

- Any material conflicts of interest exist that may have influenced the reviewer.

The SEC also expects clear and prominent disclosures to be the same font size as the written review and visible alongside the review. In other words, clear and prominent disclosures effectively become a part of the review itself and cannot be hidden or accessible only via a link.

And if you’re worried about your clear and prominent disclosures being too brief, don’t be. The SEC acknowledges the character limits of certain online platforms and further states, ‘we expect that succinctly providing these disclosures will promote their salience and impact’.

Additional Disclosures for Testimonials and Endorsements

Rest assured, the SEC also expects you to include additional disclosures, both to expand upon any clear and prominent disclosures which warrant further explanation and other required disclosures we’ll cover below. Importantly, unlike clear and prominent disclosures, these additional disclosures may be provided ‘through hyperlinks, in a separate disclosure document or any other similar methods’.

Additional Considerations: Hybrid or Dually Registered Advisors

While this guide is written primarily for SEC-registered investment advisors and investment adviser representatives preparing for compliance with the SEC Marketing Rule, it’s important for hybrid or dually registered advisors to concurrently satisfy their obligations for testimonials pursuant to FINRA’s rule 2210(d)(6).

Fortunately, you’ll find FINRA’s requirements fit easily within the SEC Marketing Rule framework. Hybrid or dually registered advisors should ensure online reviews also meet the following requirements:

- If the review discusses the investment advice you provide or investment performance, the review must prominently disclose the following:

- The fact that the testimonial may not be representative of the experience of other customers,

- The fact that the testimonial is no guarantee of future performance or success, and

- If more than $100 in value is paid for the testimonial, the fact that it is a paid testimonial

- If the review discusses a technical aspect of investing, the reviewer must have the knowledge and experience to form a valid opinion

FINRA requires that disclosures be provided in close proximity to the review or ‘through a clearly marked hyperlink accompanying the testimonial using language such as “important testimonial information,” provided of course that the testimonial is not false, misleading, exaggerated or promissory’.

Accordingly, FINRA-required disclosures not already addressed within SEC-required disclosures can simply be included alongside the SEC-required disclosures.

Preparing Disclosures for Testimonials and Endorsements

While we distinguish clear and prominent disclosures from additional disclosures above, it’s important to consider both types of disclosures holistically when you’re preparing disclosures to accompany an online review.

Specifically, the SEC requires that you disclose the following information at the time your online review is published:

Clear and Prominent Disclosures:

- Is the reviewer a current client? Or non-client? (Note: past clients are generally considered non-clients; If they were a recent client, you should disclose as such)

- Was cash or non-cash compensation provided for the review?

- A brief statement of material conflicts of interest based on your relationship

Additional Disclosures:

- The material terms of any compensation arrangement, including a description of the compensation provided or to be provided, directly or indirectly to the reviewer for their review; If cash (or non-cash and a value is readily ascertainable), the amount should be disclosed; If a reduction in advisory fee, disclose the percentage and time period

- A detailed explanation of any material conflicts of interest on the part of the person who wrote the review resulting from your relationship with the reviewer and/or any compensation arrangement; Specifically, the disclosure should explicitly state the reviewer has an incentive to recommend you due to such compensation

Beyond these disclosure expectations, we discussed prohibited content and unsubstantiated material statements of fact in the previous section that could trigger additional disclosure requirements. By consistently following an online review pre-publication checklist to determine which disclosures are necessary to accompany your reviews, you’ll be all set.

Choosing the Right Advisor Review Platforms

Where you choose to collect, display and promote testimonials and endorsements matters. This is especially true for financial advisors and wealth management firms subject to SEC oversight.

In this section, we compare features and policies of general online review platforms (specifically Google and Yelp) to a dedicated industry online review platform (Wealthtender), and your own website to understand the pros and cons of each. We also share insights worth considering for compliance with the SEC Marketing Rule.

The table below highlights relevant features and policies you’ll want to consider when choosing the platforms you’ll use to collect, display and promote your online reviews. Once you decide on the platform(s) you’ll use, you should add a brief discussion explaining your choice(s) in your policies and procedures.

| Features and Policies of Online Review Platforms | Yelp | Wealthtender | Your Website | |

| Platform is compatible with SEC rule advertising requirements | 🔴 | 🔴 | 🟢 | 🟡 |

| SEC required disclosures can be added clearly and prominently | 🔴 | 🔴 | 🟢 | 🟡 |

| Search engine optimization (SEO) benefits | 🟢 | 🟢 | 🟢 | 🟢 |

| Profile pages are exclusive to each advisor (no competitors shown) | 🔴 | 🔴 | 🟢 | 🟢 |

| Asking for reviews is permitted | 🟢 | 🔴 | 🟢 | 🟢 |

| Offering compensation for reviews is allowed | 🔴 | 🔴 | 🟢 | 🟢 |

| Reviews can be displayed anonymously | 🔴 | 🟡 | 🟢 | 🟢 |

| Reviews collected on other platforms can be imported and promoted | 🔴 | 🔴 | 🟢 | 🟢 |

| Easy ability to remove bad actor reviews or add required disclosures | 🔴 | 🔴 | 🟢 | 🟢 |

| Ability to cancel account and concurrently remove all reviews | 🔴 | 🔴 | 🟢 | N/A |

| Turn reviews feature off and still enjoy other platform benefits | 🔴 | 🔴 | 🟢 | N/A |

| Platform has been reviewed by an experienced securities attorney | 🔴 | 🔴 | 🟢 | 🟡 |

As the table suggests, general online review platforms can be problematic for financial advisors interested in complying with the Marketing Rule. On the other hand, Wealthtender is designed for SEC compliance. Your website developer can work with your compliance team to add online review functionality to your website in an SEC-compliant manner.

⭐ Display Testimonials on Your Website with Wealthtender Widgets

To avoid the hassle of costly development work, Wealthtender offers a variety of easy-to-use widgets that advisors can use to embed and display testimonials directly on their websites. These widgets incorporate the clear and prominent disclosures required by the SEC to ensure regulatory compliance.

Yes, Financial Advisor Websites Can Now Display Testimonials. Here’s How to Get Started.

What About Other Online Review Platforms for Testimonials and Endorsements?

Beyond Google, Yelp, Wealthtender, and your own website, you may be wondering about popular social media platforms like Facebook and LinkedIn. There are also reputable websites like the Better Business Bureau, among others popular with consumers, where reviews can be written.

The same challenges largely exist for each of these platforms, just like Google and Yelp, as they’re not compatible with the SEC Marketing Rule. In each instance, unsolicited reviews should not pose any issues as long as you don’t direct prospects to visit these websites and read your reviews.

⭐ Unlock Your Reviews Trapped on Non-Compliant Platforms

No matter the future guidance provided by the SEC and as discussed in the policies and procedures section above, you can use review aggregation to import reviews from any online review platform to Wealthtender or your own website where appropriate disclosures can be added so you can compliantly promote your reviews to grow your business.

For social media platforms like Facebook, Instagram, and LinkedIn, we believe these platforms offer valuable opportunities to promote your reviews gathered on compliant platforms in posts on these sites with proper disclosures added. We’ll discuss how to promote your testimonials on social media platforms later in this guide.

Questions to Ask When Choosing an Online Review Platform for Testimonials and Endorsements

In your evaluation of online review platforms, we encourage you to ask questions that will help you decide if a platform is a good fit for your business. Here are a few questions to get you started:

- What experience do you have in the financial services industry?

- How well do you understand the SEC Marketing Rule?

- Is your platform designed for compliance with the Marketing Rule?

- How will you work with my compliance team to build trust and rapport?

- What other features and benefits does your platform offer to help grow my business?

- Why should I choose your platform over others?

Asking for Testimonials and Endorsements

As a financial advisor subject to SEC oversight, how you ask for testimonials and endorsements matters.

In this section, we’ll explain how you can solicit reviews from your clients (testimonials) and non-clients (endorsements) for compliance with the SEC Marketing Rule.

⭐ At the end of this section, you’ll find an email template you can use and further customize to ask for testimonials from your clients (along with a separate email template to ask for endorsements from non-clients). The templates are intentionally brief to quickly get straight to the point.

Before you ask for your first review, it’s important to first ensure you’ve established your policies and procedures as discussed in a previous section. Once this step is completed and your firm has achieved compliance with the SEC Marketing Rule, you’re ready to begin asking for reviews on the review platform(s) you’ve chosen.

Since online reviews are new to our industry, we’re dividing this section into three important parts. First, we’ll start by suggesting a practice exercise to conduct before you ask for your first review. Then we’ll discuss best practices when asking for your first reviews from clients and non-clients, followed by ideas to help you incorporate the process of asking for reviews into your everyday business.

1. Conducting a Testimonial Dress Rehearsal

Before asking for your first real reviews, consider the benefits of a dress rehearsal. We suggest putting yourself or a member of your team in the shoes of 2 to 3 clients and one non-client and writing mock reviews you can then evaluate using your new policies and procedures.

This is a great way to prepare yourself for actual reviews. Take the time to determine if your mock reviews trigger any SEC prohibitions to gain experience handling such scenarios. Next, craft clear and prominent disclosures to accompany the mock reviews.

Use these disclosures to begin building a disclosure library in an easily accessible document. While many reviews you receive will require unique disclosures based on individual circumstances, your disclosure library can improve consistency in your disclosures where appropriate or serve as a helpful starting point for disclosures requiring customization.

2. It’s Showtime! Asking for Your First Testimonials

The SEC wants to ensure you’re not cherry-picking reviews from your favorite clients, so it’s important to ask all of your current clients for a review when first getting started. While we’ll discuss multiple methods of asking for reviews in your everyday business, we suggest using email at the outset as an effective way to maintain records of your outreach and demonstrate to the SEC you’re not cherry-picking favorites, if requested.

Consider these tips when drafting your email and preparing to ask for reviews:

- Avoid asking for a positive review or inserting language which appears to influence a reviewer toward responding in a particular way

- Prepare a single email you’ll send to all clients – This will demonstrate to the SEC that your messaging is consistent regardless of the nature of your relationship

- Schedule the email for early morning delivery on a weekday (e.g., 5 am) or consider weekend delivery to avoid overlapping with time-sensitive client emails

- Consider reaching out to sensitive clients by phone the afternoon prior to your outreach to provide context about the email they’ll receive the next day

- Consider reaching out to brand new clients by phone in advance who might feel the email asking for a review is premature; Offer context about the SEC rule

- Are there non-clients you want to ask for a review at this time? Refer to the email template for non-clients at the end of this section as a starting point

After your initial emails have been sent, don’t worry if you don’t immediately receive reviews. You’ve checked the first box to comply with SEC requirements, and future opportunities to ask for reviews will be ample and feel more natural.

✅ The Reviews Are In.

Financial advisors have a powerful new tool to grow their business thanks to the SEC Marketing Rule and Certified Advisor Reviews™ from Wealthtender.

View LIVE Certified Advisor Reviews

3. Asking for Online Reviews in Your Everyday Business

Just as other trust-based professionals like doctors and lawyers have incorporated online reviews into their daily routines, you’re now ready to do the same. Importantly, you’ll still need to avoid SEC cherry-picking concerns, so your policies and procedures should be updated to show how your ongoing approach for review collection is consistently applied across all clients.

Consider these methods and tips for collecting reviews in your daily routine:

- Update your email signature to include a link to your profile page on an online review platform or your website where clients can write a review

- Add a new section to your client newsletter that includes a link to write a review on your profile page of an online review platform and/or your own website

- Create a flyer with instructions on how someone can write a review for you and make it accessible to clients visiting your office; If you’re on Wealthtender, include the QR code we create that links to your Wealthtender profile page

- Create an area on your website where clients can write a review and read your existing reviews; If you’re on Wealthtender, consider embedding our widget on your website to both collect and display reviews

- Create a version of your business card with a QR code linking to your profile page to periodically share with non-clients; Use it to ask for a review at the right moment

- If you offer one-time planning or project-based services, incorporate a request for a review into your workflow at the conclusion of each project

- If you ask for reviews on general online review sites, don’t encourage clients to write a review while they’re in your office as these platforms could suspect multiple reviews from your own IP address as being fraudulent

- If you plan to offer compensation in exchange for a review, consider proposing a charitable donation in the name of the reviewer; This shows your appreciation for the reviewer’s time, lessens the perception of influence, and will reflect favorably in the compensation disclosure accompanying the published review

Promoting Testimonials and Endorsements to Attract New Clients

Once you’ve begun collecting testimonials and endorsements online, you’re all set to turn your reviews into a powerful source of new referrals. And without lifting a finger, the positive reviews you’re collecting online are already sending signals to search engines like Google that you’re trustworthy and deserving of increased visibility in search results.

In this section, we’ll show you how you can promote your testimonials and endorsements online and offline to attract new clients while maintaining compliance with the SEC Marketing Rule.

And since it’s expected the most popular way to collect, display and promote testimonials and endorsements will be online reviews, we focus our discussion on promoting your testimonials and endorsements in the context of reviews published on the internet.

Why Promoting Your Testimonials and Endorsements is Important to Grow Your Business

Consumers looking to hire professionals in trust-based industries want to know they’re making the right decision. Your online reviews offer the social proof they need to choose you over another financial advisor. In fact, a popular online review platform for lawyers found that those with at least five reviews on their platform achieved four times the engagement compared to lawyers with just one review.

If you decide to not make online reviews part of your marketing strategy, another financial advisor nearby or in your niche who has several positive reviews is more likely to get the call. But not to worry! With the tips in this guide, you’re well ahead of the curve and ready to turn your digital referrals into new clients. And remember, even a single online review can turn a prospect into a client.

Keep reading for suggestions to help you promote your online reviews compliantly, and learn several ways your reviews can be republished and repurposed to magnify their client-attracting power.

Promoting Your Testimonials and Endorsements Compliantly

When you encourage prospects to read your reviews online, you trigger the SEC Marketing Rule prohibitions and disclosure requirements described throughout this guide. Specifically, the rule states that once you have ‘explicitly or implicitly endorsed or approved the information [e.g., an online review] after its publication’, you have adopted the review, thus making it an advertisement subject to the rule’s conditions.

Keep these requirements and tips in mind to compliantly promote your testimonials and endorsements:

- Only provide prospects with links to your online reviews where accompanying SEC-required disclosures are present (e.g., your website, your profile page on Wealthtender)

- Be sure each review includes all necessary clear and prominent and additional disclosures

- It’s ok to direct prospects to websites where your reviews can be sorted in different ways (e.g., sorting reviews from most to least favorable) as long as you don’t control the sorting

Ideas to Promote Your Testimonials and Endorsements Selectively (and Compliantly)

While the SEC permits you to create advertisements featuring only a subset of your reviews, you must not cause ‘any misleading implication or inference’. Fortunately, the SEC suggests this concern can be addressed by including a disclaimer that the excerpted review(s) are not representative and including a link to ‘all or a representative sample’ of your testimonials.

What this means is you’ll have opportunities to promote your reviews in a variety of ways, both online and offline. Below are a few ideas to get your creative juices flowing. As always, be sure to discuss your specific circumstances with your compliance team first.

Promoting Testimonials and Endorsements on Social Media

When it comes to popular social media sites like Facebook, Instagram, LinkedIn, and Twitter, you’ll have opportunities to promote your reviews, but doing so compliantly within the character count limitations and other constraints means it’s important to proceed with caution.

You’ll need to ensure you’re incorporating the required clear and prominent disclosures alongside the review, along with a link to a representative sample of your testimonials (e.g. reviews on your own website or Wealthtender profile page).

Twitter may prove to be the most challenging social media platform for promoting your reviews due to their character count constraints, but you’ll find Facebook, Instagram, and LinkedIn to be much more accommodating.

Since Instagram doesn’t allow links in its posts, be sure to type out the link to your full list of reviews and consider including your QR code within the post image to satisfy compliance requirements.

Promoting Your Online Reviews Offline

Just because your reviews are written online, doesn’t mean they have to stay there.

Consider creating a printed flyer or brochure with a curated selection of testimonials and endorsements with appropriate disclosures; Include the QR code provided by Wealthtender linking to your profile page with all of your reviews, or type out the link to all reviews on your website. Insert this resource into your prospect kit.

The above approach also works for full-page magazine ads, mailed postcards, and, if you want to go big, perhaps even a billboard? Of course, it’s best to walk before we run, but you get the idea.

While a business card may lack sufficient space to achieve compliance with the above approach, consider adding a QR code prospects can scan with their mobile phone to quickly pull up your profile and read all your reviews online. This can turbocharge your business card’s effectiveness.

Repurposing Your Testimonials and Endorsements to be Both Seen and Heard

Your written reviews aren’t limited to just being read. The SEC permits oral testimonials and endorsements as long as you verbally include the required disclosures concurrently (including mention of the website address people can visit to read a representative sample of your reviews and their accompanying disclosures). This means if you host your own podcast, for example, you can include verbal testimonials at the start, middle, or end of your show.

Another idea is to create a YouTube ‘video’ where the audio version of the review can be listened to while the video concurrently displays the required clear and prominent and additional disclosures. You can then post this ‘video’ on your social media accounts.

It’s important to note the SEC expects you to maintain records of any audio reviews to demonstrate your compliance with the Marketing Rule upon request. While it may be easy to pull up an older podcast episode featuring audio reviews and disclosures, social media posts may prove more difficult. Either way, the SEC suggests maintaining a script of the recording, and disclosures can demonstrate your compliance.

Seminar Marketing: Use Your Testimonials to Increase Conversions of Prospects into Clients

If you conduct educational seminars online or in your community to attract new clients, your reviews can significantly increase your conversion rate of cold prospects who become warm leads and your future clients.

Many people who attend online or in-person seminars have little or no relationship with you prior to the event. Your online reviews overcome this headwind by creating an emotional connection that builds trust and offers the social proof consumers need to hire you with confidence.

Use the ideas discussed throughout this section to incorporate your testimonials and endorsements into your seminar marketing activities before, during, and after the seminar. For example, a link to your reviews included with the seminar invitation; A flyer shared at the event showcasing reviews relevant to the seminar topic with a QR code linked to your reviews online; A post-event email linking to your reviews (which could also serve as a timely opportunity to ask for reviews from seminar attendees).

Turning Your Biggest Fans into Powerful Lead Magnets

As the number of testimonials and endorsements you collect grows, you’ll discover who among your clients and other reviewers are most enthusiastic about telling the world the value you deliver and the impact you’ve made in their lives. This is the pond you’ll want to fish in to identify clients and non-clients who may be happy to play an even larger role in helping you grow your practice.

For example, if you host a podcast, consider inviting a passionate client onto the show as a guest to elaborate on their experience working with you. Or ask if they would be willing to record a video discussing their experience in a Q&A format you can use on your website and social media.

You’ll, of course, need to pay extra attention to compliance requirements given the likelihood an extended discussion may cover a lot of ground, but with thoughtful planning ahead of time, you can steer clear of topics like investment performance that could lead to a heightened risk of prohibited content and increased regulatory scrutiny.

Bonus: What Can Financial Advisors Learn About Online Reviews from Doctors and Lawyers?

For doctors and lawyers, online reviews have simply become a fact of life and a requirement for conducting business. For financial advisors preparing for the new SEC Marketing Rule, it’s worth considering the role testimonials have played across both professions.

In a BrightLocal consumer review survey, 89% of consumers said they look at reviews of medical professionals, and 81% look at lawyer reviews. Over 80% of consumers said they believe reviews are important across both categories of professionals.

In an NRC Health Market Insights Study of over 3,000 patients, 37% said they used online reviews as their very first step in searching for a new doctor.

Additional patient findings included:

- 83% said they trust online ratings and reviews more than personal recommendations

- 48% trust online ratings and reviews as much as a recommendation from their doctor

- 75% want to see at least 7 ratings before they trust a doctor

- 66% consider reviews older than 18 months to be out of date

- 59% said positive and negative reviews are equally valuable to them

In a Martindale-Avvo survey, 6,300 consumers were asked about the criteria that mattered most to them when choosing an attorney. When asked what information they desired before their first contact with an attorney, online reviews or client testimonials ranked 5th among 20 factors. The survey also noted consumers aged 25-35 gave greater weight to reviews and testimonials than consumers over age 54.

Additional consumer findings included:

- 47% used online review sites and directories to find an attorney (more than any other resource)

- 46% read online reviews of an attorney to conduct additional research after a personal referral

As Meranda Vieyra eloquently stated in The National Law Review, “The great thing about online reviews is that you have the power to present your law firm and yourself with dignity and class, regardless of how good or bad your online reviews are.” For financial advisors preparing for the SEC Marketing Rule, these words may prove prescient.

Getting Started with Testimonials and Endorsements

We hope you found this guide helpful.

Financial advisors embracing online reviews will lead the industry in attracting new clients throughout the historic transfer of wealth from Baby Boomers to Millennials over the next decade.

Online reviews establish a human connection with prospects, demonstrating your trustworthiness and increasing their confidence in contacting and hiring you. But online reviews are just one important part of an effective marketing plan to strengthen your online reputation and attract new clients in today’s world.

At Wealthtender, we’re dedicated to helping you get found online and convert more prospects into clients. Beyond our industry-first Certified Advisor Reviews™ designed for compliance with the SEC Marketing Rule, financial advisors and wealth management firms that join Wealthtender gain recognition for their areas of specialization and SEO benefits to rank higher in Google search results.

Whether you choose to join our growing community of financial advisors and advisory firms on Wealthtender or prefer to grow on your own, we hope the information in this guide helps you achieve exceptional results with your testimonials and online reviews for years to come.

About the Author

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian

Get the Testimonials Playbook on Amazon:

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor