To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

“You should put aside at least 15% of your income for retirement, starting with your first paycheck,” I told my son. “You can include in that whatever your employer matches.”

“They don’t match,” he answered.

“Oh well, then it’s all on you,” I smiled. “It’s a good thing you’re starting early.” He had just started his first full-time job out of college.

As they say, the best time to start planning and saving for retirement (or financial independence) is as soon as you start working. The second best is right now.

If you’ve ever estimated how much you need to be able to retire, you were likely shocked. Here are ways to trim over $1 million from that target.

How Much Do You Need to Be Able to Retire?

If you’ve given any thought at all to your eventual retirement (you have, right?), this is the first and most confronting question you face.

The answer, like most in personal finance, is an unsatisfying “It depends.”

What does it depend on? Two main things — how much you’ll spend in retirement and how much you can withdraw annually from your retirement accounts.

How to Estimate Your Retirement Budget

Answering this accurately isn’t easy, especially if you’re decades away from retirement.

The good thing is that you don’t have to get it exactly right if you’re so far from retiring. You can (and should) revisit these calculations periodically and update them. For now, you just have to make a plausible assumption.

My personal recommendation is that you assume 100% of your current income, minus whatever savings you’re setting aside (after all, once you’re retired you won’t need to continue setting aside money for retirement :)). For example, if you’re making $50,000 a year and setting aside $5000, you can use the remaining $45,000 as your baseline.

There are other costs that will likely be gone in retirement, which you could also use as reductions, such as:

- Childcare costs

- College savings and/or tuition costs

- Work-related costs (e.g., commuting, professional dues, etc.)

- Term life insurance premiums

- Mortgage payments (assuming you plan to pay off your mortgage before retiring)

However, while many of these will likely go away, others, such as medical expenses, travel, recreational activities, gifts, etc. will likely go up. That’s why I prefer to use 100% replacement minus savings.

For retirement budgeting, I prefer to assume 100% replacement of current income minus any savings

What’s a Safe Withdrawal Rate from Your Retirement Accounts?

The old 5% rule

This question has been researched for decades, if not longer, and the answer isn’t completely established. Back in the 80s, the accepted rule of thumb was that you could take out 5% of your portfolio during your first year in retirement, and adjust for inflation each subsequent annual draw.

For example, say you had a $1 million portfolio, you’d draw $50,000 in Year 1 of retirement. Then, if inflation was 3%, you’d draw $51,500 for Year 2. The expectation was that the total return of the portfolio would allow it to keep you going for the typical length of retirement.

The Newer 4% Rule

In the 90s, financial advisor William Bengen studied historical returns from 1926 to 1976, and concluded that if you had the misfortune to retire just before a major market downturn such as the Great Depression or the tough markets of the 70s, drawing 5% would cause your portfolio to fall to zero too early to support a long retirement.

His conclusion was that you’d need to reduce your initial draw to only 4% of your portfolio value in Year 1 of retirement if you wanted to be nearly certain that your portfolio would last more than 33 years.

More Recent Arguments

More recently, following a bull market for the ages, experts expect market returns to be much more muted in the coming years, giving rise to suggestions that you should only count on a 3.5% or even 3% initial draw.

And the Winner Is… the 4% Rule (at Least for Me)

My take is that if you’re currently in your accumulation phase, you have enough years ahead of you that we’ll likely experience many corrections (market pull-backs of more than 10% from their recent high point) and several bear markets (market pull-backs of more than 20% from their recent high point) before you make that initial draw. Thus, assuming a 3.5% or 3% draw is too pessimistic.

That’s why I’m sticking with the 4% rule for my own retirement planning. However, to mitigate the risk that I’m wrong and that 3% is the right number, I’m diversifying my retirement income planning so not all of it comes from investment returns (more on that below).

And thus, to Retire You Need…

Based on all the above, the simplest plausible way to estimate how much you need to be able to retire is to take your current income, subtract what you’re setting aside each year, and then multiply the remaining number by 25 (so 4% of this new number is equal to your estimated retirement budget).

As a rough estimate of what you need to retire, multiply by 25 your current income minus savings you’re setting aside

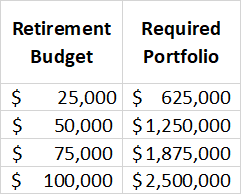

Here are some examples of what that may mean for you.

The portfolio value you need to retire is approximately 25x your retirement budget

If your reaction is something like “I need to put aside how much?! Over a million bucks?! No way!!!” don’t despair, even if your current retirement portfolio is worth far too close to $0 and far below these mountainous amounts.

Rather than taking mountain-climbing lessons and buying virtual mountain-climbing gear, we can cut those mountains down to a more scalable height.

The Best Way to Scale an Overwhelming Mountain is to Cut It Down

The first chop will be courtesy of good old Social Security.

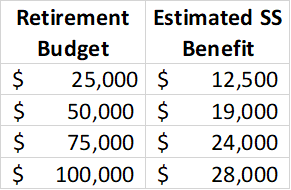

Social Security benefits replace a large portion of your income at the lowest levels, and a gradually smaller part as your income grows

I know. I know. If you’re targeting a $100,000 retirement budget, getting $28,000 from Social Security seems completely inadequate.

It is. Social Security benefits were never intended to completely replace your working income, especially if you make a solid middle-class income (or more). However, they do help chop down the mountainous portfolio value you need…

Your required portfolio size gets dramatically reduced once you consider your expected Social Security benefits

As you can see, for someone trying to replace a $25,000 annual income, the required portfolio size gets cut in half. Even for a $100,000 budget, you can trim your target portfolio by $700,000. That’s not chump change!

But Social Security Won’t Be there for Me! (Or Will It?)

Many, if not most, younger Americans believe Social Security will not be there once they retire.

While none of us was given the gift of prophesy, the current best estimate comes from the Congressional Research Service, which estimates that once the Social Security Trust Fund is depleted (in 2035, unless Congress does something before then), promised benefits would need to be cut by 20%.

Not great, but certainly a lot better than being 100% gone, which is what so many (erroneously) expect.

Your required portfolio size gets dramatically reduced, even with only 80% of your promised Social Security benefits

Even at this reduced level, Social Security cuts your required portfolio by more than 40% for a $25,000 retirement budget, and by $560,000 for a $100,000 budget.

Even at 80% of promised benefits, Social Security reduces your required portfolio by $560,000 for a $100,000 budget

The Next (and Bigger) Chop — A Side Income in Retirement

Having some other source of income in retirement, even if it’s not a lot, helps even more.

Assuming a 20%-reduced Social Security benefit plus a $30k annual side income in retirement has an even more dramatic impact

Here we can see that between your (20%-reduced) Social Security benefit and a $30k side income, you actually don’t need any retirement savings for a $25,000 retirement budget (as a caveat, it’s best if that $30k side income doesn’t require your active participation since you may not be healthy enough to do much work).

For a $50,000 budget, you need less than 10% of what you would have needed before we started chopping.

Even for a $100,000 budget, you need less than half the original portfolio size, about $1,300,000 less!

Between Social Security and a side income, you could cut more than a million bucks off what you need to set aside for retirement.

How Do You Get There?

Building Your Portfolio

In a piece I plan to post soon, I’ll provide a simple, easy-to-implement way to save enough to reach financial independence much sooner than you’d think you can.

For now, I’ll just give you the cheat-sheet version… Start by setting aside as much as you can today, even if it’s only 1% of your income, then, each time you get a raise, increase your savings by half the amount of the raise.

Start by setting aside today as much as you can, even if it’s only 1% of your income, then, each time you get a raise, increase your savings by half the amount of the raise.

The earlier you start, and the larger a percentage of your income that you set aside for retirement, the better (for two reasons that I discuss here).

That’s why I had that discussion with my son you saw at the start of this article, so he’d get as much of a head start as possible. I had a similar conversation with my middle daughter, and will have one with my youngest once she graduates from college.

Setting up a Side Income (a Non-Exhaustive List of 7 Possibilities)

Finally, here are some ideas on how to come up with that $30k side income in retirement.

- Pensions: Few of us have one of these anymore, but if you do, that’s the easiest way to bring in extra income in retirement

- Immediate income annuities: The 4% rule is designed for your portfolio to survive severe market downturns. However, if you don’t need the money to fund a bequest, you could use some (or even all) of your portfolio to purchase immediate income annuities. These provide guaranteed payouts that can continue until your eventual death. Many factors affect the payout levels, but if you don’t require having the provider return any money to your estate upon your death, they can be far more generous than the 4% we’ve assumed for your portfolio. For example, as of this writing, according to the Charles Schwab Income Annuity Estimator, a 65-year-old single male in Maryland buying a $500,000 single-premium immediate income annuity could expect to get annual payouts of $31,224 for his lifetime, a 6.24% annual payout.

- Rental properties: Each time you move from a house you own to a new one you plan to buy, consider if you can keep the old house and rent it out (in a future piece I’ll describe how I did this myself). If rents in your area are high enough, you might clear 00 a month, or $12,000 a year. Even better, you may be able to shield some income from taxes through depreciation, and your ongoing mortgage payments will continue to increase your equity, ultimately benefiting your heirs.

- Ongoing sales: If you’re a writer, you can work on building a large enough body of work that can add up to a good chunk of the side income you want. For example, an author who sells a thousand copies of her various books per month on average, clearing say $3 per copy, would have an ongoing side income of about $36,000 a year.

- Hobby income: If you’re into less-well-known collectibles (e.g., vintage watches, pens, etc.), you can trade on that knowledge to buy such items inexpensively from estate sales, garage sales, etc. and then sell at their higher actual value. Similarly, if your hobby is creating jewelry, lamps, furniture, etc. selling such hand-crafted items online can be lucrative.

- Part-time work: You could also use your lifetime of knowledge and expertise to work very part time as a consultant, tutor, etc. For example, if you tutor 10 hours a week at $50 an hour, that can add up to more than $25,000 a year. As an added benefit, the continued social and mental engagement will likely make your retirement more fulfilling, ward off mental decline, and even extend your life.

- Reverse mortgages: I add this one mostly because some people won’t be able to build a side income from the other 6 ideas. If you have no better option and want to pursue this one, educate yourself thoroughly before signing anything. The gist of this arrangement is that if you own your home, you can continue living in it and get a lender to provide you with a lifetime of monthly payments. However, upon your death, the lender gets to sell your home to pay back that stream of payments along with the accrued interest. Often, there will be little if anything left for your heirs. Another problem is that moving to a different home (say to be closer to your kids) becomes complicated.

The Bottom Line

Retirement planning is one of the most important and challenging tasks in personal finance. It depends on many factors that you can’t know accurately in advance, so you have to use rules of thumb and plausible estimates.

However, the fact that it’s challenging and that the amounts you’re told you need to accumulate are daunting must not stop you from doing at least a minimum of planning right away, and starting to invest for it.

If you don’t, you’ll join the dismal statistics showing how most Americans are woefully under-prepared for retirement. You can see here some estimates of how much you should already have saved for retirement given your age.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor