Get your questions answered and take a deeper dive into the benefits of joining Wealthtender

Wealthtender is the #1 find-an-advisor directory

Wealthtender is the #1 find-an-advisor online directory not sponsored by a wealth management firm, credentialing organization, or industry association.

Frequently Asked Questions

Why do financial advisors join Wealthtender?

Wealthtender is a modern digital marketing platform helping top advisors build authority as a leader in their areas of specialization to attract clients who are a good fit for their practice.

Most people do their research online before deciding where to eat, what to buy, or the professionals they hire. The next generation of investors are no different when it comes to choosing a financial advisor.

Wealthtender helps people find the best financial advisors for their individual needs, no matter their income or stage of life. With hundreds of articles, guides, and easy-to-use directories, advisors who join Wealthtender are attracting their ideal clients and boosting their reputation online.

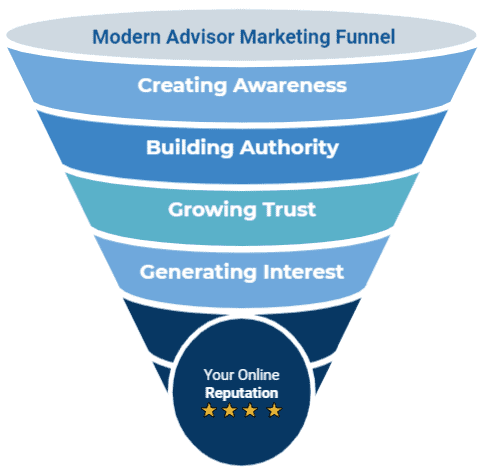

With thousands of people visiting wealthtender.com each month, we deliver a high-value, low-cost complement to traditional advisor marketing efforts to strengthen your top and middle-of-the-funnel activities and optimize your online reputation.

What are Certified Advisor Reviews™?

Certified Advisor Reviews™ from Wealthtender are designed to comply with the new SEC Marketing Rule and provide the transparency consumers deserve when their life savings could be at stake. For example, consumers will know if:

- Compensation in any form was provided for a review

- Conflicts of interest may have influenced a review

- A review was written by a client or other acquaintance of the advisor

To earn the Certified Advisor Review™ mark, a review must display this information clearly and prominently, along with supplemental disclosures provided by financial advisors to meet federal and/or state regulatory requirements.

Financial advisors on Wealthtender who remain in good standing are authorized to display the Certified Advisor Reviews™ badge on their website, email signature, and social media accounts.

What if I’m not ready to get started with testimonials yet?

It’s ok. You’re not alone. We know it could take some time before you’re able to move forward depending upon your registration status at federal and state levels (and when your compliance team is ready to give you the green light). When you’re ready, we’ll be here to help you get started.

Join Wealthtender today to strengthen your online reputation, build authority in your areas of specialization, and attract your ideal clients. With so many benefits to help you grow your business, you’re in good company as the majority of financial advisors on Wealthtender aren’t able to get started with testimonials either.

How Does Wealthtender Compare to Hiring a PR Agency?

Many PR agencies charge a minimum of $5,000 / month with a commitment of several months to get started. By comparison, it costs 99% less to join Wealthtender.

Hiring a PR agency is generally best for advisors interested in media appearances on television shows and live broadcast interviews, areas beyond the scope of Wealthtender services.

Most advisors interested in strengthening their SEO, getting quoted in online publications, and generating long-term ROI from digital marketing can accomplish a tremendous amount by joining Wealthtender for less than the cost of a tank of gas each month.

Given the choice of spending $5,000 in one month with a PR agency, or gaining 10 years of digital marketing benefits with Wealthtender for the same cost, most advisors will see enduring results and a much more significant ROI by joining Wealthtender.

Learn how Wealthtender helps financial advisors get quoted in the media.

How does Wealthtender compare to other advisor digital marketing platforms?

With thousands of consumers visiting Wealthtender each month and through our national syndication partnerships with sites like MSN.com, Wealthtender is uniquely positioned to help advisors attract their ideal clients.

No financial advisor digital marketing platform offers the features and benefits that set Wealthtender apart. Examples include:

- Enhance top and middle-of-the-funnel marketing effectiveness by creating greater awareness, building authority, and establishing trust

- Collect and display Certified Advisor Reviews™ to turn your clients’ feedback into powerful testimonials that drive referrals to your business. (Note: this is an optional feature that by default is turned off and can be turned on by advisors who choose to opt-in.)

- Get quoted and featured in articles and guides to build authority in areas of specialization to attract ideal clients.

- SEO benefits by being featured on Wealthtender to improve advisor visibility and ranking in Google search results.

- Weekly promotion opportunities for advisors to amplify the reach of their own articles and other content on social media.

- Consumer discovery of advisor website content through WISE, our proprietary personal finance search engine.

- Content Boost helps you turn your website into a powerful marketing tool to attract more prospects while driving deeper engagement with your current clients.

Wealthtender complements the marketing solutions you value most and can replace legacy platforms no longer delivering results.

⚖️ A Deeper Dive: How Does Wealthtender Compare to Other Digital Marketing Solutions?

Why should financial advisors join Wealthtender?

For financial advisors looking to grow their practice, Wealthtender offers a low cost, high value complement to other marketing efforts with features designed to strengthen your top and middle of the marketing funnel efforts.

In fact, Michael Kitces identified paid web listing services like Wealthtender as “rounding out the top 5 most-efficient strategies” for advisor marketing dollars when it comes to client acquisition, and that’s before taking into account the additional features and benefits offered exclusively to financial advisors in our community.

And now with Certified Advisor Reviews™ from Wealthtender, you’re ready to lead the industry in attracting new clients over the next decade.

Unlike many paid listing services where your profile page is all you get, Wealthtender offers advisors opportunities to also be quoted in articles, featured in guides, and gain added reach on social media each week.

We’re always looking for new ways to help advisors grow. You can sign up for a monthly subscription plan and cancel anytime. It’s up to us to earn your business each and every month. When it comes to digital marketing for financial advisors, we’re committed to delivering unprecedented value.

How much does Wealthtender cost?

Wealthtender offers monthly subscription plans for financial advisors starting at less than $1/day.

How has Wealthtender prepared for the SEC Marketing Rule?

The SEC Investment Adviser Marketing rule offers exciting opportunities for financial advisors to attract new clients and boost their online reputation.

Wealthtender is the first independent financial advisor review platform designed to be fully compliant with the new SEC rule to help advisors make the most of this historic opportunity.

Unlike Google Reviews which display competitors on advisor profile pages and lack required SEC disclosures, Wealthtender is specifically designed to help advisors stand apart while complying fully with the regulations unique to our industry.

We were the first platform mentioned by Michael Kitces for our thought leadership in this area and we’re working closely with industry leaders and stakeholders to ensure a superior experience for advisors on the Wealthtender platform.

To learn more about how Wealthtender compares to Google Reviews and other potential financial advisor review platforms, click here.

I’m Ready to Join. How Do I Get Started?

It’s easy to join financial advisors on Wealthtender who know the power of modern marketing to grow their business.

1️⃣ Click here to choose your subscription plan.

2️⃣ Provide a few details and begin to personalize your profile page.

3️⃣ Watch your inbox for tips to make the most of your subscription.

Simple as that! Have questions? Email yourfriends@wealthtender anytime.

Supercharge Your Marketing ROI.

Joining Wealthtender comes with a LOT of perks.

From benefits that strengthen your online reputation and SEO, to features designed to increase your visibility and build trust with future clients, your marketing budget will barely budge, while your marketing results rev up.

To help financial advisors make the most of their Wealthtender experience, we created a guide covering the wide range of benefits available to help you grow your business.

Want a sneak peek?

A Top 5 Marketing Strategy for Advisors

Wealthtender helps advisors build authority, gain national media recognition, strengthen their SEO, and attract their ideal clients with done-for-you digital marketing services.

With monthly subscription options starting around $1/day and no long-term commitment, get started today and enjoy:

✅ Free Done-for-You Setup

✅ Impactful Digital Marketing Benefits

✅ Lots of Perks. Low Monthly Cost

💡 How Does Wealthtender Compare to Other Digital Marketing Strategies?

Wealthtender offers affordable done-for-you digital marketing benefits to complement your favorite tools and replace others not meeting your expectations. Below are a few comparisons of Wealthtender to other digital marketing tools available to financial advisors.

Wealthtender vs. Find-An-Advisor Websites

Beyond the opportunity for prospects to discover you on find-an-advisor websites, SEO ranks as one of the most valuable digital marketing benefits of your profile page. This is one of the reasons why listing platforms like Wealthtender ranked in a recent survey conducted by Michael Kitces as a top 5 marketing strategy.

When you join Wealthtender, you benefit from our industry-leading Domain Authority (a search engine ranking score that predicts how likely a website is to rank in search engine result pages). Here’s a comparison:

💡 Learn more about the benefits of creating profiles on find-an-advisor-websites.

Wealthtender vs. "Get Quoted in the Media" Services

For financial advisors on a very tight budget, free services like HARO offer opportunities to get quoted in the media, but with considerable noise and competition that can make it challenging to stand out.

On the other end of the spectrum, you'll find PR agencies that charge thousands of dollars a month or hundreds of dollars per quote placement they secure on your behalf.

When you sign up for a monthly Wealthtender Growth ($39/month) or Elite ($59/month) subscription plan, you gain opportunities every month to get quoted on wealthtender.com, MSN.com, popular finance websites in our network, and media outlets affiliated with the Associated Press for no additional cost.

Here's a comparison of Wealthtender to two "get quoted in the media" services:

| Service Provider | Typical Cost |

|---|---|

| Wealthtender | $49/Month |

| Qwoted (Qwoted.com) | $150/Month |

| Vetted (JoinVetted.com) | $350+/Article |

Wealthtender vs. Review Platforms

Where you choose to collect, display and promote testimonials and endorsements matters. This is especially true for financial advisors and wealth management firms interested in making the most of the new SEC Marketing rule to succeed with online reviews compliantly.

When you're ready to get started with testimonial marketing, Wealthtender offers the industry's first playbook with templates and checklists to turn your online reviews into a powerful source of digital referrals for years to come. Below is a quick comparison of Wealthtender to Google reviews, or click here for a deeper dive with tips to choose the right online review platform for you.

| Features and Policies | Wealthtender | |

|---|---|---|

| Search Engine Optimization Benefits | 🟢 | 🟢 |

| Compliant with SEC Marketing Rule | 🟢 | 🔴 |

| Anonymous Client Reviews Permitted | 🟢 | 🔴 |

| Turn Reviews Feature On/Off Anytime | 🟢 | 🔴 |

| No Competitors Shown On Your Page | 🟢 | 🔴 |

💡 Learn more about Certified Advisor Reviews™ from Wealthtender.

🚀 How Does Done-for-You Digital Marketing Work?

The Industry’s First Done-For-You Digital Marketing Toolkit for Advisors Who Prefer Working Smarter, Not Harder

Wealthtender helps advisors succeed online to build authority, gain national media recognition, strengthen their SEO, and attract their ideal clients with done-for-you digital marketing services. For example:

🛎️ We create your profile page; You personalize it if you choose.

🛎️ We write and publish articles on wealthtender.com that reach thousands of people each month; You simply provide a quote to gain visibility and SEO benefits.

🛎️ We syndicate articles on sites like MSN.com and Associated Press affiliates; You simply provide a quote to reach a national audience.

🛎️ We amplify your best content on social media each week; You simply provide a link.

And when you’re ready to get started with testimonials, Wealthtender is the first financial advisor online review website compliant with the SEC Marketing rule. We provide you with the playbook to succeed with testimonial marketing and attract the next generation of investors to your practice.

We're dedicated to helping advisors work smarter, not harder, with plans beginning around $1/day.

Wealthtender and other paid web listing platforms rank as a category among the Top 5 Most Cost-Effective Marketing Strategies for advisors. Expand below to learn more.

Expand to Learn More

According to a 2020 industry benchmarking study conducted by Michael Kitces at Nerd's Eye View, paid web listing platforms like Wealthtender rank as a category among the Top 5 Most Cost-Effective Marketing Strategies for advisors.

This article authored by Michael Kitces offers valuable insights into the marketing strategies of more than 800 financial advisors who participated in a 2020 industry benchmarking study.

We're grateful for the tireless efforts by Michael Kitces and his team whose passion for advisor excellence positively influences how we design Wealthtender to help financial advisors grow their business with modern advisor marketing.

Please click the link below to read this article on Nerd's Eye View.

The Most Efficient Financial Advisor Marketing Strategies And The True Cost To Acquire A Client

Enhance the Top of Your Marketing Funnel.

The top of the modern advisor marketing funnel is all about creating awareness for your professional brand & your unique services.

When you join Wealthtender, you gain visibility with thousands of visitors to wealthtender.com each month who want to improve their financial well-being.

Your optimized Wealthtender profile page showcases your experience, credentials and areas of specialization to help consumers looking for a financial advisor make more informed hiring decisions.

And by connecting your calendar tool using Calendly, HubSpot or dozens of other platforms, the top of your marketing funnel isn't just creating awareness, it could also be sending you future clients.

Is the top of your marketing funnel in tip-top shape?

(And the Middle of Your Funnel, Too.)

The middle of your marketing funnel involves building authority and growing trust to generate interest among the right prospects for your practice.

By joining Wealthtender, your benefits include opportunities to be featured and quoted in published resources to gain:

- Optimal visibility to attract your ideal clients at exactly the right time

- Search engine optimization benefits helping your website rank higher

- Highly shareable content for use with clients, prospects and COIs

How are you building authority online to attract your ideal clients?

The World Has Changed. Are You Ready?

The next generation of investors doesn't want to be sold to; They want to feel informed and educated.

Modern Advisor Marketing with Wealthtender ensures your future clients gain the knowledge and reassurance they’re looking for online to hire you with confidence and conviction.

With plans starting around $1 / day, you're joining financial advisors on Wealthtender positioned to lead the industry in attracting new clients throughout the historic transfer of trillions of dollars in wealth from Baby Boomers to Millennials over the next decade.

Gain National Media Recognition.

And So Much More.

💬 Getting quoted in major publications and popular websites is an effective way to build authority, strengthen your online reputation, and boost your SEO to rank higher in online search results.

Financial advisors who sign up for a Wealthtender Growth or Elite subscription plan enjoy exclusive opportunities to gain national media recognition on sites like MSN.com, hundreds of newspapers nationwide through Associated Press syndication, and visibility across personal finance websites in the Wealthtender Financial Network. Click here to learn more.

Explore the Gallery to View Recent Articles and Quotes

Choose the Best Plan for Your Needs.

Enjoy Hundreds of Dollars in Marketing Benefits Each Month. Starting Around $1/Day.

Whether you handle marketing yourself or partner with a marketing consultant, joining Wealthtender is a smart and affordable way to amplify your marketing efforts and accelerate your opportunities for growth.

With our Done For You quick start option available at no additional cost, you'll enjoy benefits right away without lifting a finger. Or choose the Hands On option to get started today personalizing your profile as easy as editing your LinkedIn page.

Simply choose the subscription plan best for you. Every plan comes with an affordable monthly cost and no long-term commitment. Change plans or cancel anytime. We work hard to earn your business each month.

Get Started with Testimonials.

The new SEC Marketing rule opens the door to new opportunities. And new risks.

We prepared this step-by-step playbook to help you compliantly turn your online reviews into an evergreen source of digital referrals. You might also enjoy our SEC Marketing Rule Education Series of articles, templates, and checklists designed to help you get started with testimonials and endorsements.

Wealthtender Founder and CEO Brian Thorp is a leading industry voice and subject matter expert on the SEC Marketing rule. View recent media mentions:

Compliance Week: New SEC marketing rule offers opportunities, compliance challenges

"Wealthtender is a vendor that publishes financial adviser testimonials that are compliant with the new marketing rule."

Compliance Week

Model FA Podcast: Modernized Marketing Rules for Financial Advisors

🎙 Model FA Podcast Episode 38 - Host David DeCelle interviews Brian Thorp, Wealthtender Founder and CEO, on Modernized Marketing Rules for Financial Advisors.

(Listen to the Interview: Apple Podcasts, Stitcher, Spotify)

Unable to Get Started with Testimonials?

It's ok. You're not alone. We know it could take some time before you're able to move forward depending upon your registration status at federal and state levels (and when your compliance team is ready to give you the green light). When you’re ready, we’ll be here to help you get started.

Join Wealthtender today to strengthen your online reputation, build authority in your areas of specialization, and attract your ideal clients. With so many benefits to help you grow your business, you're in good company as the majority of financial advisors on Wealthtender aren't able to get started with testimonials either.

Introducing Certified Advisor Reviews™.

Certified Advisor Reviews™ help consumers make smarter hiring decisions when choosing a financial advisor.

Wealthtender is the first financial advisor review platform designed to be fully compliant with the SEC Investment Adviser Marketing rule. (Learn More)

With Certified Advisor Reviews™, you can:

- Confidently ask your clients (and acquaintances) for reviews

- Promote your reviews to attract new clients

- Strengthen your online reputation with clients and prospects

- Establish your trustworthiness with Google and Bing

- Demonstrate your consumers’ interests first mindset

- Unlock reviews trapped on sites like Google and Yelp

- Import and certify reviews from Google & all other platforms

Thinking about asking for reviews on sites like Google or Yelp? Think again.

We'll be the first to admit if we're wrong. But we're not wavering in our belief that forthcoming SEC guidance will clarify that review platforms like Google and Yelp simply aren't compatible with the SEC Marketing rule, thus limiting acceptable use of these platforms to only include unsolicited reviews.

Here’s What We Know with Certainty:

Google and Yelp are well-known review platforms popular with consumers. And many advisors already have unsolicited reviews written about them visible on these sites. If these are favorable reviews and are truly unsolicited, that’s terrific as advisors gain SEO benefits and visibility among consumers visiting these sites.

But because reviews on Google and Yelp lack the required SEC disclosures to be considered advertisements (e.g. testimonials and endorsements you can promote to grow your business), advisors can’t direct prospects to check out their reviews on these platforms.

Here’s What We Don’t (Yet) Know:

Unlike unsolicited reviews published on Google or Yelp, the SEC has not formally offered guidance to clarify if solicited reviews on Google and Yelp are deemed an advertisement, and therefore subject to the prohibitions and disclosure requirements described in the SEC Marketing rule. So the question we need the SEC to answer is: Does the act of a financial advisor simply asking for a review to be written on specific platforms like Google or Yelp entangle an advisor in its creation and trigger the prohibitions and disclosure requirements?

While industry opinions are mixed on the guidance the SEC will ultimately provide, we believe it’s highly likely the SEC will take issue with advisors proactively soliciting reviews on platforms known to be incompatible with the Marketing rule. With its principles-based rule intended to ensure consumers gain important information to make more informed decisions, we don’t expect the SEC to look favorably upon a rampant proliferation of advisor reviews on platforms incapable of addressing the Marketing rule’s prohibitions and disclosure expectations.

Further, we believe the SEC could point to FINRA Regulatory Notice 17-18 that addresses this topic covering testimonials of registered representatives. In the notice, FINRA states: “FINRA does not regard unsolicited third-party opinions or comments posted on a social network to be communications of the broker-dealer or the representative for purposes of Rule 2210, including the requirements related to testimonials in paragraph (d)(6).”

Wealthtender has submitted written requests for clarification on this matter to the SEC (likely along with many other industry participants) and we monitor the SEC’s Marketing rule FAQ page daily. We’ll share updates as additional SEC guidance becomes known.

October 12, 2021 Update: The SEC Investment Adviser Regulation Office (within the Division of Investment Management) responded by email to Wealthtender confirming their team will consider updating the SEC Marketing rule FAQ page to address the analogous question answered by FINRA in Regulatory Notice 17-18 that could put this matter to rest.

Turn Certified Advisor Reviews on at any time. We're ready when you are.

Michael Kitces Offers His Perspective on Certified Advisor Reviews™

“… Wealthtender is launching a more centralized “Advisor Reviews” platform, where advisors can sign up for a page on Wealthtender that centralizes all of their Google, Yelp, and other third-party website reviews, and repackages them as “Certified Advisor Reviews” (reviewed by Wealthtender) for which the advisor can add a Reviews badge to their website (linking to their Wealthtender profile).

...Nonetheless, the reality is that because testimonials have long been recognized as such a powerful marketing tool – including in financial services, where for decades they were only banned because they were deemed too influential and at risk for abuse! – it seems inevitable that client testimonials will soon become a core part of advisor marketing. The only question is how, exactly, advisory firms will find it best to collect and share them for the (right) prospects to see?”

- Michael Kitces at Nerd's Eye View

The Latest in Financial #AdvisorTech (June 2021)

Build Trust with Online Reviews

to Get More Clients Online.

🎉 The new SEC Marketing Rule is a game-changer in advisor marketing.

🥇 Wealthtender is the first SEC-compliant financial advisor review platform.

⭐ Your online reviews become an evergreen source of digital referrals.

😲 Unlike Google Reviews, you don't have to make your client list public.

Learn How Wealthtender Helps You Succeed with Testimonial Marketing

Wealthtender is the first financial advisor online review website compliant with the new SEC Marketing Rule. We provide you with the playbook to succeed with testimonial marketing so you can attract the next generation of investors to your practice.

How Wealthtender Compares to General Review Platforms

Where you choose to collect, display and promote testimonials and endorsements matters. This is especially true for financial advisors and wealth management firms interested in making the most of the new SEC Marketing Rule to succeed with online reviews compliantly.

When you're ready to get started with testimonial marketing, Wealthtender offers the industry's first playbook with templates and checklists to turn your online reviews into a powerful source of digital referrals for years to come. Below is a quick comparison of Wealthtender to Google reviews, or click here for a deeper dive with tips to choose the right online review platform for you.

| Features and Policies | Wealthtender | |

|---|---|---|

| Search Engine Optimization Benefits | 🟢 | 🟢 |

| Compliant with SEC Marketing Rule | 🟢 | 🔴 |

| Anonymous Client Reviews Permitted | 🟢 | 🔴 |

| Turn Reviews Feature On/Off Anytime | 🟢 | 🔴 |

| No Competitors Shown On Your Page | 🟢 | 🔴 |

💡 Learn more about Certified Advisor Reviews™ from Wealthtender.

Learn How Certified Advisor Reviews™ Help You Get More Clients Online

Introducing Certified Advisor Reviews™

Certified Advisor Reviews™ help consumers make smarter hiring decisions when choosing a financial advisor.

Wealthtender is the first financial advisor review platform designed to be fully compliant with the SEC Investment Adviser Marketing rule. (Learn More)

With Certified Advisor Reviews™, you can:

- Confidently ask your clients (and acquaintances) for reviews

- Promote your reviews to attract new clients

- Strengthen your online reputation with clients and prospects

- Establish your trustworthiness with Google and Bing

- Demonstrate your consumers’ interests first mindset

- Unlock reviews trapped on sites like Google and Yelp

- Import and certify reviews from Google & all other platforms

Michael Kitces Offers His Perspective on Certified Advisor Reviews™

“… Wealthtender is launching a more centralized “Advisor Reviews” platform, where advisors can sign up for a page on Wealthtender that centralizes all of their Google, Yelp, and other third-party website reviews, and repackages them as “Certified Advisor Reviews” (reviewed by Wealthtender) for which the advisor can add a Reviews badge to their website (linking to their Wealthtender profile).

...Nonetheless, the reality is that because testimonials have long been recognized as such a powerful marketing tool – including in financial services, where for decades they were only banned because they were deemed too influential and at risk for abuse! – it seems inevitable that client testimonials will soon become a core part of advisor marketing. The only question is how, exactly, advisory firms will find it best to collect and share them for the (right) prospects to see?”

- Michael Kitces at Nerd's Eye View

The Latest in Financial #AdvisorTech (June 2021)

Thinking about asking for reviews on sites like Google or Yelp? Think again.

We'll be the first to admit if we're wrong. But we're not wavering in our belief that forthcoming SEC guidance will clarify that review platforms like Google and Yelp simply aren't compatible with the SEC Marketing rule, thus limiting acceptable use of these platforms to only include unsolicited reviews.

Here’s What We Know with Certainty:

Google and Yelp are well-known review platforms popular with consumers. And many advisors already have unsolicited reviews written about them visible on these sites. If these are favorable reviews and are truly unsolicited, that’s terrific as advisors gain SEO benefits and visibility among consumers visiting these sites.

But because reviews on Google and Yelp lack the required SEC disclosures to be considered advertisements (e.g. testimonials and endorsements you can promote to grow your business), advisors can’t direct prospects to check out their reviews on these platforms.

Here’s What We Don’t (Yet) Know:

Unlike unsolicited reviews published on Google or Yelp, the SEC has not formally offered guidance to clarify if solicited reviews on Google and Yelp are deemed an advertisement, and therefore subject to the prohibitions and disclosure requirements described in the SEC Marketing rule. So the question we need the SEC to answer is: Does the act of a financial advisor simply asking for a review to be written on specific platforms like Google or Yelp entangle an advisor in its creation and trigger the prohibitions and disclosure requirements?

While industry opinions are mixed on the guidance the SEC will ultimately provide, we believe it’s highly likely the SEC will take issue with advisors proactively soliciting reviews on platforms known to be incompatible with the Marketing rule. With its principles-based rule intended to ensure consumers gain important information to make more informed decisions, we don’t expect the SEC to look favorably upon a rampant proliferation of advisor reviews on platforms incapable of addressing the Marketing rule’s prohibitions and disclosure expectations.

Further, we believe the SEC could point to FINRA Regulatory Notice 17-18 that addresses this topic covering testimonials of registered representatives. In the notice, FINRA states: “FINRA does not regard unsolicited third-party opinions or comments posted on a social network to be communications of the broker-dealer or the representative for purposes of Rule 2210, including the requirements related to testimonials in paragraph (d)(6).”

Wealthtender has submitted written requests for clarification on this matter to the SEC (likely along with many other industry participants) and we monitor the SEC’s Marketing rule FAQ page daily. We’ll share updates as additional SEC guidance becomes known.

October 12, 2021 Update: The SEC Investment Adviser Regulation Office (within the Division of Investment Management) responded by email to Wealthtender confirming their team will consider updating the SEC Marketing rule FAQ page to address the analogous question answered by FINRA in Regulatory Notice 17-18 that could put this matter to rest.

Turn Certified Advisor Reviews on at any time. We're ready when you are.

💡 Learn more about Certified Advisor Reviews™ from Wealthtender.

View LIVE Certified Advisor Reviews 👀

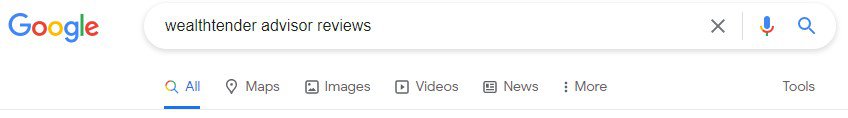

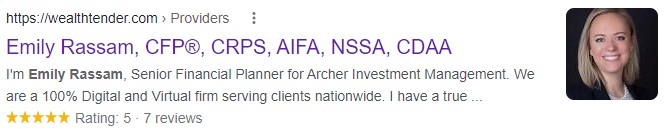

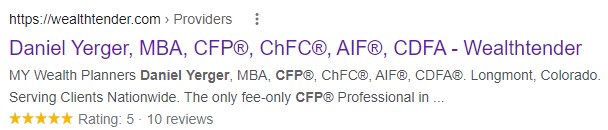

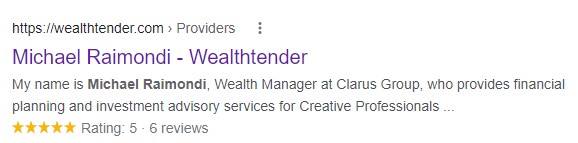

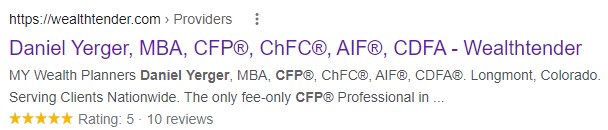

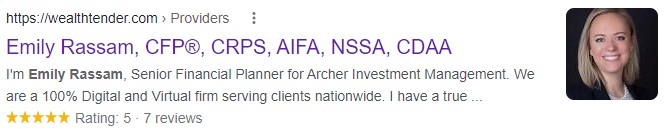

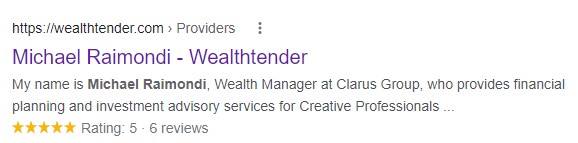

When you gather reviews from clients on your Wealthtender profile page, Google begins to take notice.

Usually, once you have collected around 5 Certified Advisor Reviews on Wealthtender, Google will begin to display the gold stars you've earned next to your name when people search for you online.

This is a great way to get more clicks and stand out in search results.

✅ Click any screenshot example below to view LIVE Certified Advisor Reviews that help these advisors stand out in Google search results.

Get Your FREE Playbook

Turn your online reviews into an evergreen source of digital referrals.

➡️ View More Highly Rated Advisors

Unable to Get Started with Testimonials?

It's ok. You're not alone. We know it could take some time before you're able to move forward depending upon your registration status at federal and state levels (and when your compliance team is ready to give you the green light). When you’re ready, we’ll be here to help you get started.

Join Wealthtender today to strengthen your online reputation, build authority in your areas of specialization, and attract your ideal clients. With so many benefits to help you get more clients online, you'll be in great shape to get started with testimonials and online reviews when you're ready.

Turn Your Website into a Powerful Marketing Tool with Content Boost 🚀

📰 Gain access to 100+ articles on a broad range of topics, plus new articles monthly.

🧲 Get more prospects to your website and strengthen your email communications.

🚀 Attract more prospects and drive deeper engagement with your current clients.

Learn How Elite Plan Subscribers Grow Their Business with Content Boost 🚀

Use Content Boost to create or supplement your content library on your website.

🧲 Get more prospects to your website by creating social media posts with excerpts from Content Boost articles with a link to the full article on your website.

📩 Strengthen your email communications to prospects and clients by featuring excerpts from Content Boost articles as teasers with links that drive more traffic to the full article on your website.

🤝 Save time when meeting with clients or answering their questions about a particular financial planning topic by using Content Boost excerpts and articles to support your talking points.

💡 Build authority and demonstrate your knowledge of financial planning topics by adding callout quotes to Content Boost articles featuring your own insights and perspectives.

👩💻 Create links from Content Boost articles to your original articles that can improve search engine optimization (SEO), helping your content rank higher in Google search results.

Each article in the Content Boost library is available in a Google Doc, viewable online, or downloadable as a Microsoft Word document.

Articles are formatted and optimized for publishing on the web and are easy to copy and paste into your content management system.

While other benefits offered by Wealthtender help your ideal prospects discover you and get to your website, Content Boost helps you keep them there. Turn your website into a powerful marketing tool to attract more prospects while driving deeper engagement with your current clients.

Establish Yourself as a Top Advisor for Employees of Fortune 500 Companies (and Beyond)

👀 Get discovered by company employees and executives actively searching for financial planning help.

🚀 Gain SEO (Search Engine Optimization) benefits to your website and/or firm employee landing page.

📰 Boost your credibility as a specialist with reporters covering company news and events.

Learn the Benefits of Being Featured in a Large Employer Q&A

If you currently serve clients who work for a large employer, you've likely gained valuable insights by reviewing their benefits and compensation packages to create financial plans tailored to their unique circumstances.

Wealthtender can help you attract more clients employed at these firms.

The Wealthtender Large Employer Q&A article series showcases advisors in our community who have experience helping employees and executives at large employers, including Fortune 500 companies and beyond.

Here's an example of a Q&A article we published featuring Kushal Shah, a financial advisor based in Thousand Oaks, CA. The article is designed to help Kushal gain recognition among Amgen employees as a financial advisor who knows the company and can speak their language:

Your Amgen Benefits & Career: Financial Planning for Employees and Executives

The Benefits of Being Featured in a Q&A

When you're featured in a Q&A article on Wealthtender as an advisor with specialized knowledge working with employees of a large firm, the benefits are many, including:

✅ Greater visibility among company employees and executives actively searching online for financial planning help specific to their firm's benefits and compensation plan.

✅ Highly shareable content. Employees who discover the article online are more likely to share the article with other employees because it's prepared specifically for them.

✅ An easy way to ask for referrals. Send an email to your current client(s) who work at the firm with a link to the article on Wealthtender. Beyond feeling proud they're working with an advisor who knows their firm, they will quickly recall this article in future conversations with colleagues when discussing their benefits or compensation.

✅ Search Engine Optimization (SEO) benefits via the link back to your website (and/or landing page you have/create for employees of the company on your website).

✅ Boost your credibility with reporters and media outlets. When large companies announce an acquisition, round of layoffs, or another event impacting employees, reach out to industry/local business reporters to offer your commentary and help them write their story. Sharing a link to your Q&A article demonstrates your credibility as an expert source.

Get More Clients Online with

Impactful Digital Marketing.

📈 Your digital marketing investment compounds over time.

🔎 An increasing number of your future clients will find you directly online.

💰 And when they do, your advisory fee is yours to keep.

Learn More

Many advisor lead gen platforms take a percentage of your management fee when they match you with a prospect. While these services can be effective in adding new clients, the cost can be steep.

When you join Wealthtender, your flat fee digital marketing investment compounds over time, paying dividends when an increasing number of your future clients find you directly online. And when they do, your advisory fee is yours to keep.

Your Wealthtender profile page is SEO-optimized to ensure you benefit from our industry-leading Domain Authority (a search engine ranking score that predicts how likely a website is to rank in search engine result pages).

📰 We create your SEO-optimized profile. You can personalize it if you choose.

🏆 You benefit from our industry-leading Domain Authority.

📞 Prospects book introductory meetings with one-click access to your calendar.

If you already have a profile page on websites like Fee Only Network, IndyFin, Wiser Advisor, or other directory sites, you benefit from their Domain Authority (DA) that influences how you rank in online search results. And many of these sites have done a nice job in the past helping advisors strengthen their online presence.

But unlike many other sites, Wealthtender continues to invest significantly in growth initiatives to propel our DA to new heights for the benefit of financial advisors in our community. For example, we frequently:

- Publish fresh content to attract more visitors and increase search engine visibility

- Syndicate Wealthtender articles on popular finance sites, MSN.com, and via Associated Press

- Gain national media recognition for our content and thought leadership boosting our DA

In a 2020 industry benchmarking study conducted by Michael Kitces at Nerd’s Eye View, paid web listing platforms rank as a category among the Top 5 Most Cost-Effective Marketing Strategies for advisors.

By joining Wealthtender, you benefit from a top 5 marketing strategy, plus your digital marketing ROI is supercharged with our DA score that's unprecedented in the category, along with many additional benefits all designed to help you get more clients online.

For around $1/day, your profile page on Wealthtender strengthens your SEO to help you attract your ideal clients and rank higher in search results. You're unlikely to find a better bang for your buck.

For personalized insights with tips to help you get more clients online, request your free digital marketing report from Wealthtender. Simply fill out this brief form, and we'll email your personalized report to you within one business day.

Join Wealthtender and Get Featured on our Website and Beyond:

📰 Wealthtender on Google News | 📰 Wealthtender on MSN

Thousands of people visit wealthtender.com each month looking for financial professionals and resources they can trust. And millions of people turn to Google News and MSN, where financial advisors in the Wealthtender community are regularly featured.

Advisory Firm Growth Solutions

We help wealth management firms grow faster and more profitably

with flat fee lead generation and digital marketing services.

How Will Your Firm Get Clients Online?

(Without Sacrificing Your Revenue.)

Many lead gen platforms take a significant percentage of your management fee when they match your advisors with a prospect. While these services can be effective in adding new clients quickly, the cost can be steep.

When your firm joins Wealthtender, your flat fee digital marketing investment compounds over time, paying dividends when an increasing number of your future clients find you and your advisors directly online. And when they do, your advisory fee is yours to keep.

Wealthtender complements revenue-sharing lead gen platforms in the near term while positioning you to acquire an increasing percentage of clients organically for years to come. You'll also enjoy a 15% advisory firm discount when you sign up for Wealthtender with multiple advisors.

Brian Thorp

Wealthtender Founder & CEO

LinkedIn Profile

Email: brian@wealthtender.com

Phone: (512) 856-5406

Increase Visibility for Your Firm.

And Collect Testimonials Compliantly.

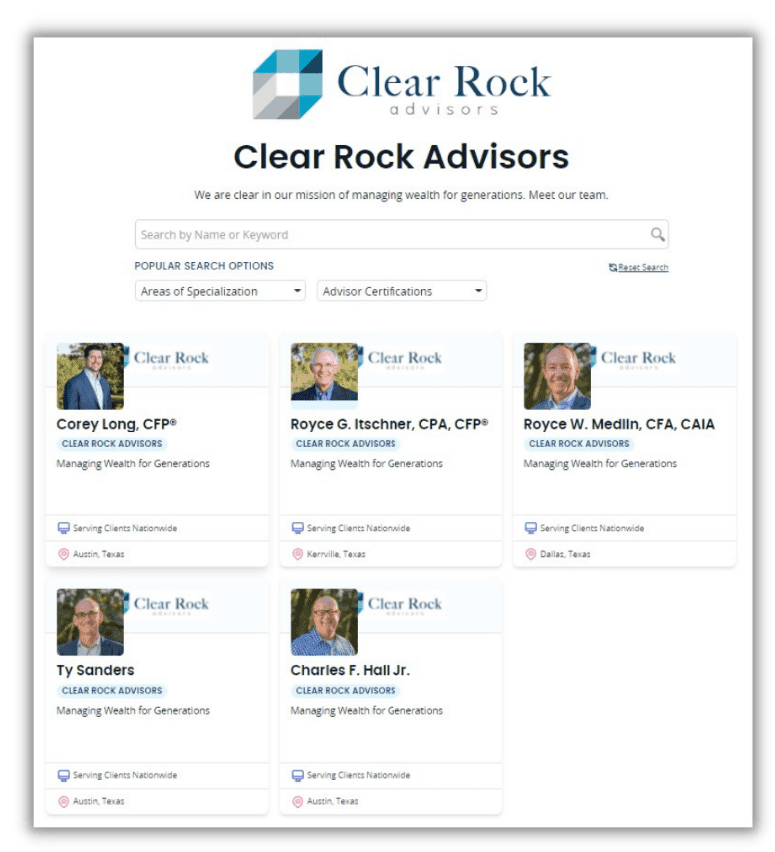

When two or more financial advisors from the same firm join Wealthtender, we’ll create a profile page for your firm for inclusion in the Advisory Firm Directory.

Your firm profile page offers an additional way for prospective clients to learn what’s unique about your services and team, with quick access to individual profile pages for each affiliated advisor.

You can also collect and display testimonials for your firm in compliance with SEC Marketing rule requirements. Learn more about Certified Advisor Reviews™.

Showcase Your Firm on Wealthtender.

Stand Out and Strengthen Your SEO.

In addition to your firm's directory listing, a showcase Q&A article published on Wealthtender helps you reach a broader audience and provides SEO benefits to increase your firm's visibility in online search results.

We'll work with you to determine a few questions that can help people understand what makes your firm unique with answers provided by your founder, CEO, or another team member.

Recent Firm Showcase Examples for:

Use Custom Widgets from Wealthtender for Your Firm's Unique Needs

Looking for White Label Solutions?

Whether you’re looking for a fully compliant plug & play solution to showcase your advisors and their Certified Advisor Reviews on your website, or you’re interested in customized widgets without incurring development costs, white label solutions from Wealthtender may be ideal for your needs.

With widgets designed for easy installation on your own website or hosted for you on wealthtender.com, we’re happy to discuss ways we can help you achieve your goals.

Request Your Free Personalized Digital Marketing Report from Wealthtender

For personalized insights with tips to help you get more clients online, request your free digital marketing report from Wealthtender. Simply fill out this brief form, and we'll email your personalized report to you within one business day.